The authority explained that Group O blood, the universal blood group that can also be used in emergencies by patients of any blood group, is most susceptible to fluctuations due to its high demand.

“Our collection has not been able to meet the hospitals’ usage,” it said, adding that its blood stock has run lower during the mid-year school holiday period, with the daily number of units of blood donated “well below” the number of blood units utilised. “This shortage is worsened by long weekends. Without adequate blood donation, we risk having insufficient blood to meet the needs of critically ill patients in all our hospitals,” said HSA., even as the overall number of donors went up.The Singapore Red Cross expressed concern then, noting that getting more donors to start young was crucial to ensure the sustainability of blood supply for both emergencies and patients who require regular transfusion.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Blood donors needed as stocks for O+, O- and AB- run low during holiday periodAs of Friday, stock levels for blood types O+, O- and AB- were low. Read more at straitstimes.com.

Blood donors needed as stocks for O+, O- and AB- run low during holiday periodAs of Friday, stock levels for blood types O+, O- and AB- were low. Read more at straitstimes.com.

Read more »

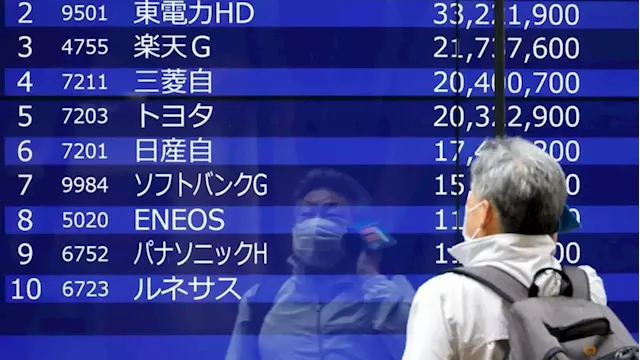

Stocks stall as US rates seen higher for longerSINGAPORE : Asian stocks braked around two-month highs on Thursday, while the dollar nursed modest losses, after the U.S. Federal Reserve chose not to hike interest rates for the first time in 17 months, even if it opened the door to more hikes ahead.The Fed left its benchmark funds rate window at 5-5.25

Stocks stall as US rates seen higher for longerSINGAPORE : Asian stocks braked around two-month highs on Thursday, while the dollar nursed modest losses, after the U.S. Federal Reserve chose not to hike interest rates for the first time in 17 months, even if it opened the door to more hikes ahead.The Fed left its benchmark funds rate window at 5-5.25

Read more »

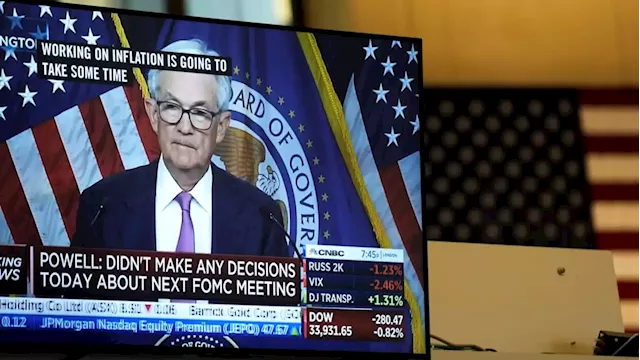

Stocks rise, dollar pares losses after Fed signals more hikes aheadMSCI's global equity index closed slightly higher on Wednesday (Jun 14) after a volatile afternoon while the dollar cut its losses after the US Federal Reserve paused interest rate hikes as

Stocks rise, dollar pares losses after Fed signals more hikes aheadMSCI's global equity index closed slightly higher on Wednesday (Jun 14) after a volatile afternoon while the dollar cut its losses after the US Federal Reserve paused interest rate hikes as

Read more »

Analysis:Thai stocks flounder in absence of China sparkSINGAPORE : Thailand's stock market has become the symbol of investor disenchantment with China's economic reopening, going from market darling in January to Asia's second-worst performing markets by June, with little sign of a turnaround. Not only has the promised export boom and tourism boost from China

Analysis:Thai stocks flounder in absence of China sparkSINGAPORE : Thailand's stock market has become the symbol of investor disenchantment with China's economic reopening, going from market darling in January to Asia's second-worst performing markets by June, with little sign of a turnaround. Not only has the promised export boom and tourism boost from China

Read more »

Thai stocks flounder in absence of China spark(Corrects typo in first paragraph)By Rae Wee and Patturaja Murugaboopathy SINGAPORE :Thailand's stock market has become the symbol of investor disenchantment with China's economic reopening, going from market darling in January to Asia's second-worst performing market by June, with little sign of a t

Thai stocks flounder in absence of China spark(Corrects typo in first paragraph)By Rae Wee and Patturaja Murugaboopathy SINGAPORE :Thailand's stock market has become the symbol of investor disenchantment with China's economic reopening, going from market darling in January to Asia's second-worst performing market by June, with little sign of a t

Read more »

China takes next step in currency globalization, with some HK stocks priced in yuanSHANGHAI/HONG KONG : China's gradual internationalisation of its currency will shift to its next leg on Monday when about two dozen Chinese companies start trading in their home currency in Hong Kong's stock market.Hong Kong stocks such as Alibaba and Tencent are among the 24 stocks which will be priced a

China takes next step in currency globalization, with some HK stocks priced in yuanSHANGHAI/HONG KONG : China's gradual internationalisation of its currency will shift to its next leg on Monday when about two dozen Chinese companies start trading in their home currency in Hong Kong's stock market.Hong Kong stocks such as Alibaba and Tencent are among the 24 stocks which will be priced a

Read more »