Everything Selloff Snowballs While Traders Adjust to Fed’s RealitySEC to Impose New Rules for Labeling Popular Investment FundsOnly Fund Beating Nasdaq Long-Term Is Defying Stock-Picking OddsBond yields climb as U.S.

4 Billion Token HoardETF Traders Are Pouring Cash Into EM’s Non-China Growth EnginesPlaying for global basketball and sponsorship gloryFanDuel, Rivalry deliver something new for betting customersWomen’s Tennis Is More Unpredictable — And Fun — Than Ever Going Into US OpenDifficult conversations regarding hockey's 'toxic masculinity' continue at summitMLB makes strides in attracting younger fans, ticket buyers in growing the gameRoyals unveil proposed ballpark, entertainment district...

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

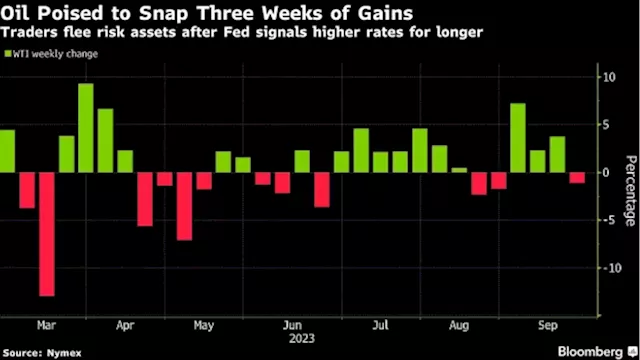

Oil Set for Weekly Loss as Hawkish Fed Overshadows Tight Market(Bloomberg) -- Oil headed for its first weekly loss in four after the Federal Reserve flagged a further rise in US interest rates this year, damping appetite for risk assets and overshadowing physical tightness in the crude market.Most Read from BloombergEx-Goldman Bankers Make a Fortune With Controversial Bet on CoalIndia Suspends Visas, Canada Pulls Diplomats Amid Tensions‘Dead Space’ Co-Creator Departs Startup After Newest Game FlopsWall Street Trading Roiled by ‘Post-Fed Hangover’: Markets W

Oil Set for Weekly Loss as Hawkish Fed Overshadows Tight Market(Bloomberg) -- Oil headed for its first weekly loss in four after the Federal Reserve flagged a further rise in US interest rates this year, damping appetite for risk assets and overshadowing physical tightness in the crude market.Most Read from BloombergEx-Goldman Bankers Make a Fortune With Controversial Bet on CoalIndia Suspends Visas, Canada Pulls Diplomats Amid Tensions‘Dead Space’ Co-Creator Departs Startup After Newest Game FlopsWall Street Trading Roiled by ‘Post-Fed Hangover’: Markets W

Read more »

Oil Set for Weekly Loss as Hawkish Fed Overshadows Tight MarketOil headed for its first weekly loss in four after the Federal Reserve flagged a further rise in US interest rates this year, damping appetite for risk assets and overshadowing physical tightness in the crude market.

Oil Set for Weekly Loss as Hawkish Fed Overshadows Tight MarketOil headed for its first weekly loss in four after the Federal Reserve flagged a further rise in US interest rates this year, damping appetite for risk assets and overshadowing physical tightness in the crude market.

Read more »