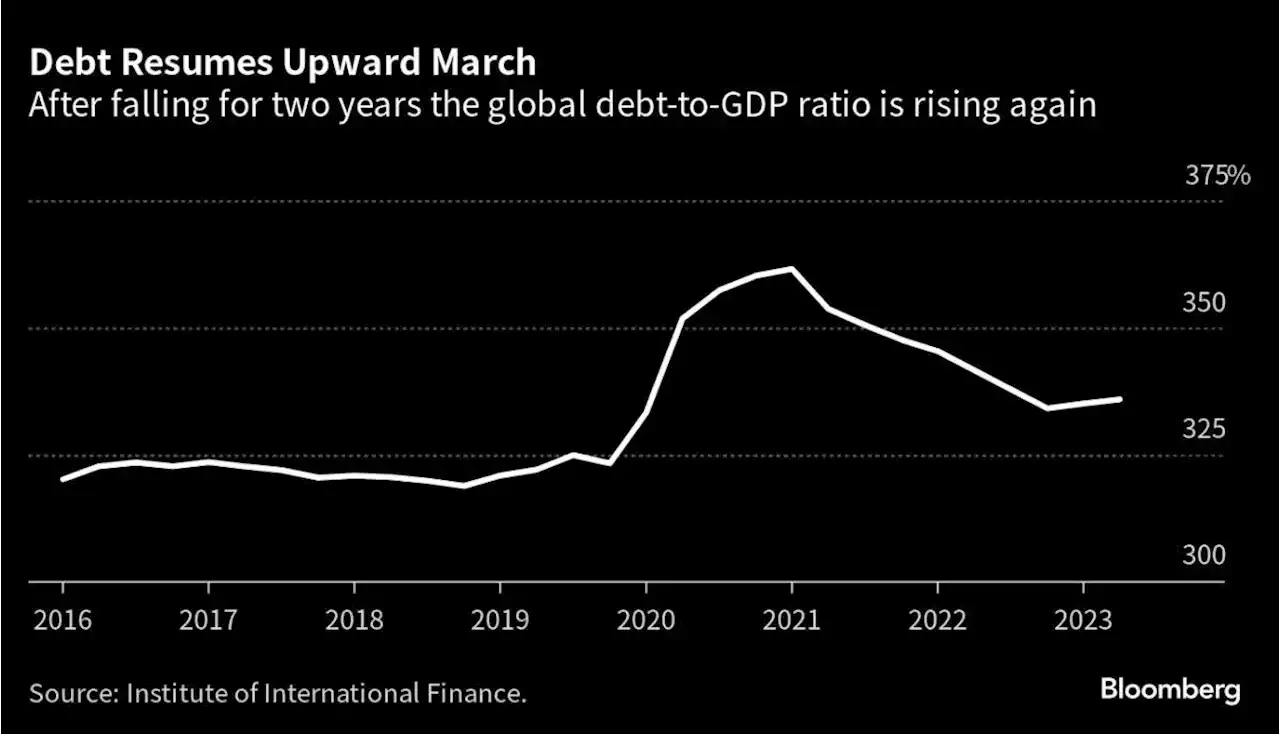

Credit markets may be stable as the global economy proves resilient, but some of the titans of the debt world told the Bloomberg Global Credit Forum in London this week that they see looming headwinds as the impact of higher interest rates slowly filters through to consumers and companies.

Governments like the UK’s that borrowed heavily during the pandemic now face a reckoning as they grapple with much higher interest rates. The cost of servicing US federal debt jumped by 25% in the first nine months of the fiscal year, according to data through June. “The big risk now, in the global context, is obviously what happens with deficit spending,” he said. “There’s a bigger risk we make a mistake there.”Swiss Life’s investment arm and Scotland’s Baillie Gifford are avoiding direct lending in part because of transparency fears, a lack of liquidity and the good returns available elsewhere. Abrdn Plc says it lends to investment-grade borrowers, but not to the riskier companies that make up much of this market.

China Evergrande Group canceled key creditor meetings that had been set for early next week and said it must reassess its proposed restructuring. Some investors are bidding up legal claims on Credit Suisse’s additional tier 1 debt in a bet they can recover some value from the bonds that were wiped out during the UBS Group AG takeover.Blackstone Inc.’s head of European and APAC Private Credit Paulo Eapen is set to leave by the end of the year, after 17 years at the company.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Lawrence Lepard, founder of Equity Management Associates, on why gold companies have performed poorlyA roundup of all the mining news in the precious metals sector with a variety of company news, mining sector analysis, newsletter writer insights and executive interviews.

Lawrence Lepard, founder of Equity Management Associates, on why gold companies have performed poorlyA roundup of all the mining news in the precious metals sector with a variety of company news, mining sector analysis, newsletter writer insights and executive interviews.

Source: KitcoNewsNOW - 🏆 13. / 78 Read more »