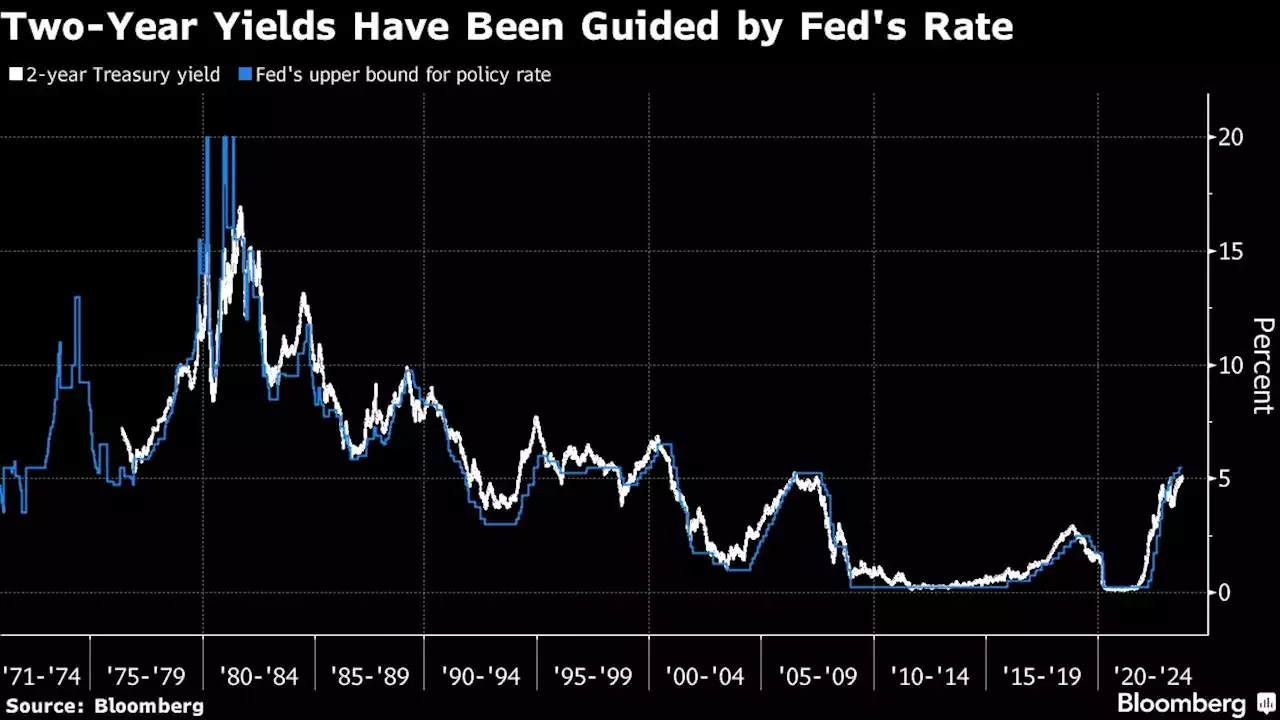

While individuals are piling into cash, for many portfolio managers the debate now is about how far to go in the other direction. Two-year yields above 5% haven’t been this lofty since 2006, while 10-year yields eclipsed 4.5% on Friday for the first time since 2007.

To extend further out, he said, “you have to have a stronger view that the labor market is going to crack.” That scenario might lead investors to bet on a recession, spurring a Treasuries rally and fueling outsize gains in longer maturities, a function of their greater sensitivity to changes in interest rates.“You can be very patient before stretching your neck out to get duration in the Treasury market,” he said.

Jack McIntyre at Brandywine Global Investment Management said he expects the 4.5% area should hold for the 10-year, given recent weakness in equities and rising oil prices. It may all be a question of time horizon. For those with lengthier investment mandates, longer-dated Treasuries are at levels that mean “your starting point for future returns is pretty attractive,” said Michael Cudzil, a portfolio manager at Pacific Investment Management Co.

The upshot, he said, is “a steeper yield curve with long-term rates that just remain elevated even if the market finally gets comfortable with the Fed going on hold.”Sept. 25: Chicago Fed national activity index; Dallas Fed manufacturing activity

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bond Market Faces Quandary After Fed Signals It’s Almost DoneBond investors face the crucial decision of just how much risk to take in Treasuries with 10-year yields at the highest in more than a decade and the Federal Reserve signaling it’s almost done raising rates.

Bond Market Faces Quandary After Fed Signals It’s Almost DoneBond investors face the crucial decision of just how much risk to take in Treasuries with 10-year yields at the highest in more than a decade and the Federal Reserve signaling it’s almost done raising rates.

Read more »

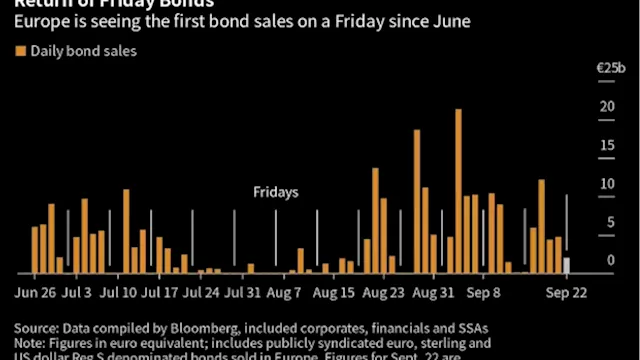

Europe’s Bond Market Sees First Activity on a Friday Since JuneThe bond market in Europe is open for business on a Friday for the first time since June.

Europe’s Bond Market Sees First Activity on a Friday Since JuneThe bond market in Europe is open for business on a Friday for the first time since June.

Read more »