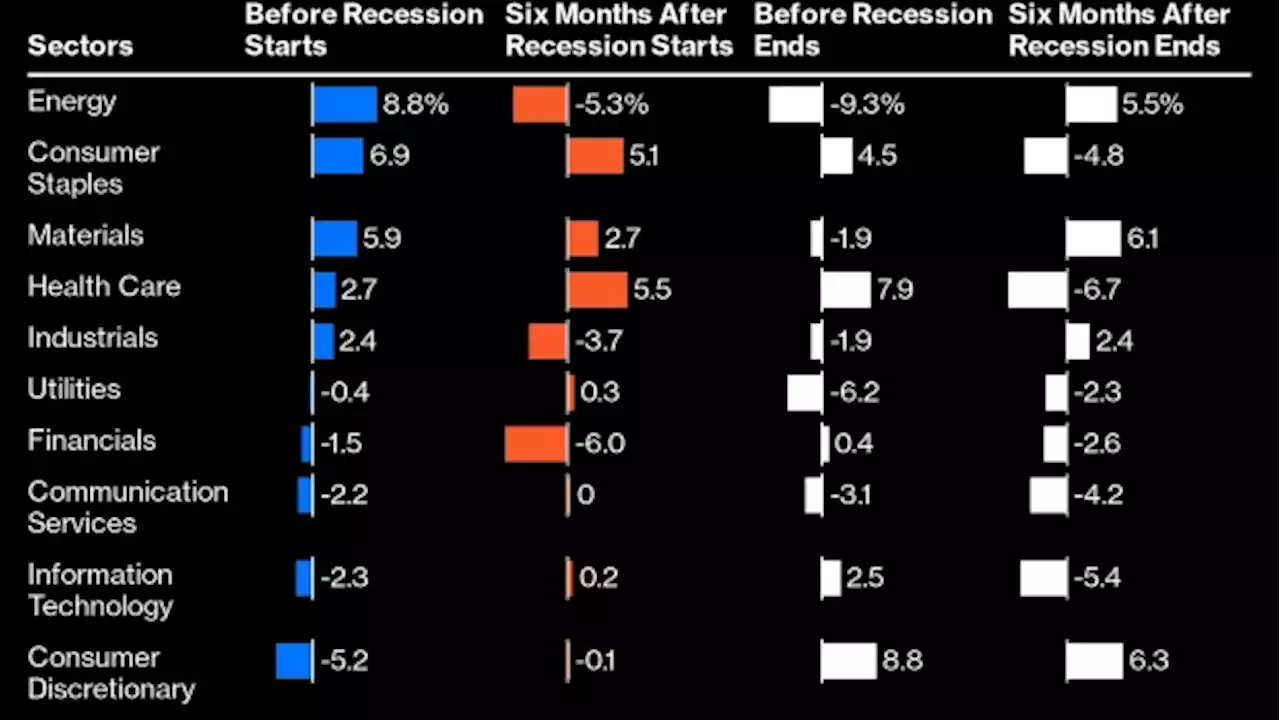

The S&P 500 Industrials index peaked on Aug. 1 and is down about 8% since then, teetering on a correction after several major US carriers cut their profit outlooks for the third quarter on a sudden jump in oil prices. The small-cap Russell 2000 Index has lost more than 11% from its July 31 closing high, roughly twice the decline in the S&P 500 Index over the same time. Steep drops in small-cap and industrial stocks typically occur when the economy is in a recession.

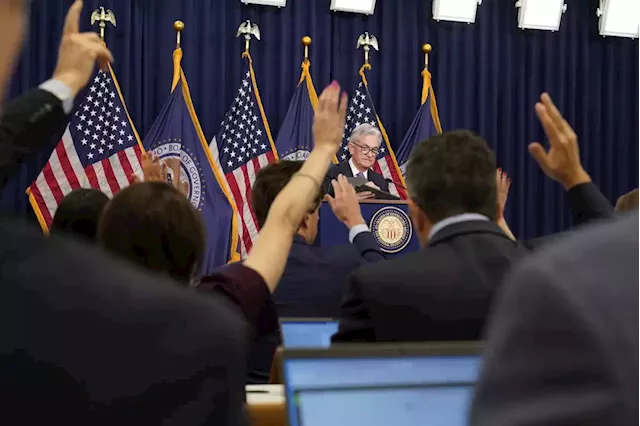

That said, there is hope for stocks. Earnings season is coming, which may matter more than rates for stock prices now according to a model from Bloomberg Intelligence. Companies are expected to post profit declines of just 1.1% in the third quarter, followed by gains for at least the next year, according to Bloomberg Intelligence data. Plus the Federal Reserve this week said it’s forecasting stronger economic growth than it expected just a few months ago.

“It’s too soon to say the stock market is signaling a recession,” said Ed Clissold, chief US strategist at Ned Davis Research, whose firm has a year-end target of 4,500 on the S&P 500 and forecasts a chance that the US will slump into an economic slowdown in the first half of 2024. “If we are marching toward that, it would appear this would be at very early stages, but we need to wait a few more weeks to see where the year-end momentum is going.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Yields slip, stocks waver as Fed officials warn of higher ratesMarket News

Yields slip, stocks waver as Fed officials warn of higher ratesMarket News

Source: KitcoNewsNOW - 🏆 13. / 78 Read more »

Real estate stocks extend losses as rates soarShares in real estate companies fell on Friday, adding to a massive sell-off the previous day, when bond yields jumped to their highest levels in 16 years after the Federal Reserve signaled that U.S. interest rates would stay high for longer. The S&P 500 real estate index lost 0.7% on Friday after falling 3.5% on Thursday, which was its biggest daily decline since March when the banking sector was in crisis. The U.S. Treasury 10-year yield, fell slightly on Friday, after rising on Thursday to around 4.5%, its highest since 2007.

Real estate stocks extend losses as rates soarShares in real estate companies fell on Friday, adding to a massive sell-off the previous day, when bond yields jumped to their highest levels in 16 years after the Federal Reserve signaled that U.S. interest rates would stay high for longer. The S&P 500 real estate index lost 0.7% on Friday after falling 3.5% on Thursday, which was its biggest daily decline since March when the banking sector was in crisis. The U.S. Treasury 10-year yield, fell slightly on Friday, after rising on Thursday to around 4.5%, its highest since 2007.

Source: YahooFinanceCA - 🏆 47. / 63 Read more »

Stock market reaction to Fed is overdone, Wall Street bull saysStocks sold off for two days following the Federal Reserve meeting but one strategist believes higher interest rates might not be so bad for stocks.

Stock market reaction to Fed is overdone, Wall Street bull saysStocks sold off for two days following the Federal Reserve meeting but one strategist believes higher interest rates might not be so bad for stocks.

Source: YahooFinanceCA - 🏆 47. / 63 Read more »

Real estate stocks extend losses as rates soarBy Sinéad Carew (Reuters) - Shares in real estate companies fell on Friday, adding to a massive sell-off the previous day, when bond yields jumped to ...

Real estate stocks extend losses as rates soarBy Sinéad Carew (Reuters) - Shares in real estate companies fell on Friday, adding to a massive sell-off the previous day, when bond yields jumped to ...

Source: SaltWire Network - 🏆 45. / 63 Read more »