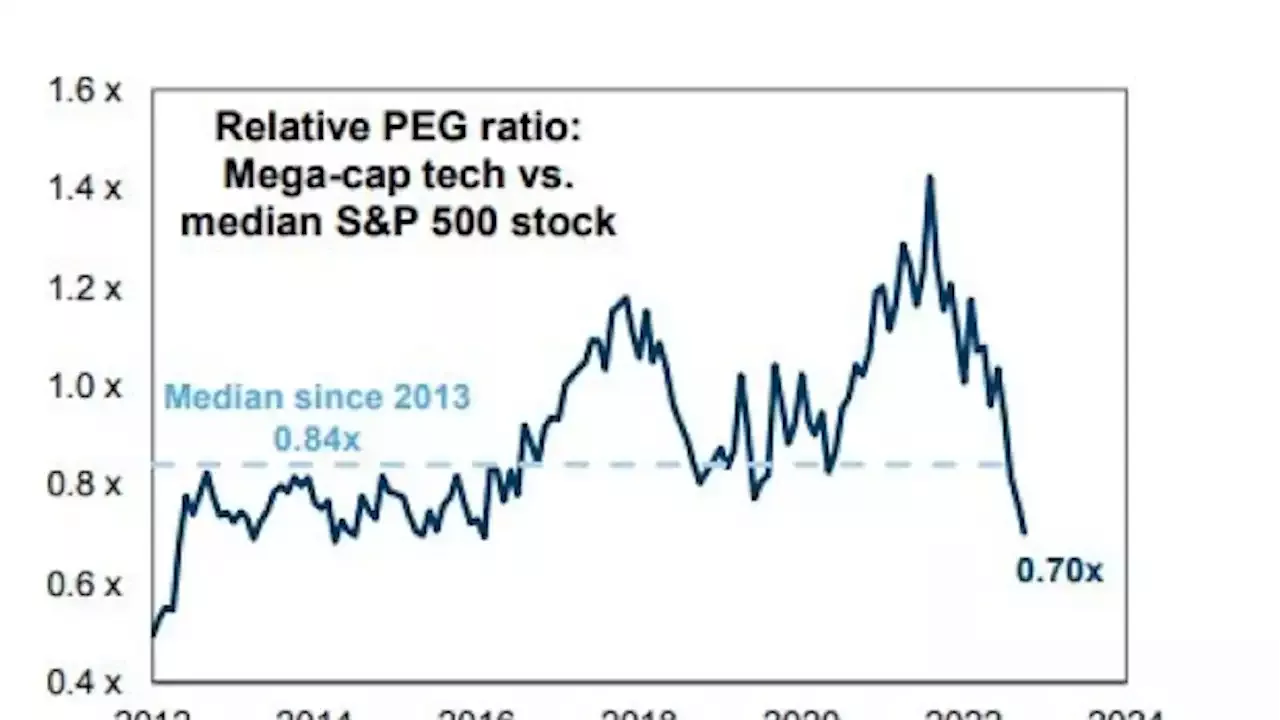

They say the selloff has led to historically cheap valuations for the tech stocks at a time when earnings estimates are still rising. In particular, they point to a valuation metric known the PEG ratio, which calculates price relative to earnings and long-term growth.

“The divergence between falling valuations and improving fundamentals represents an opportunity for investors,” strategists including Cormac Conners and David Kostin wrote in a note dated Oct. 1. With the focus now turning to the third-quarter earnings, expectations around tech are holding up better than the rest of the market. A Citigroup Inc. index shows profit upgrades are still outnumbering downgrades for tech stocks.

The Goldman strategists said history also bodes well for the sector’s performance during the reporting season. The largest tech stocks have outperformed the equal-weighted S&P 500 more than 60% of the time since 2016, typically by 3 percentage points, they said. That holds true even when forecasts have risen going into the season.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Nike's earnings showed a consumer slowdown won't derail all retailersCommentary from Nike executives showed that despite mounting headwinds, demand isn't slowing down for the global athletic apparel leader.

Nike's earnings showed a consumer slowdown won't derail all retailersCommentary from Nike executives showed that despite mounting headwinds, demand isn't slowing down for the global athletic apparel leader.

Read more »

Oil Latest: Halliburton CEO Sees Market Tightening FurtherMinisters and oil industry chiefs are gathering for the biggest energy conference in the Middle East as crude heads toward $100 a barrel. Whether prices can hold at these levels and the outlook for OPEC+ supply cuts are among topics that will be discussed from Monday.

Oil Latest: Halliburton CEO Sees Market Tightening FurtherMinisters and oil industry chiefs are gathering for the biggest energy conference in the Middle East as crude heads toward $100 a barrel. Whether prices can hold at these levels and the outlook for OPEC+ supply cuts are among topics that will be discussed from Monday.

Read more »