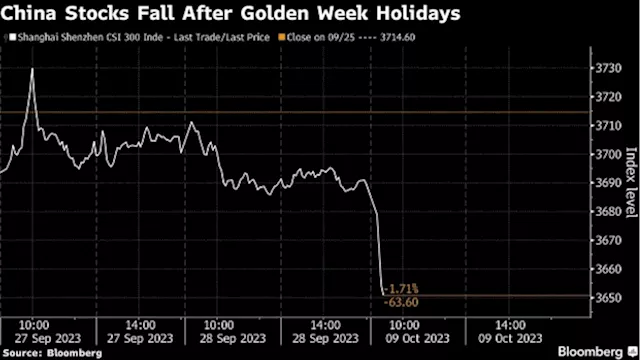

-- Chinese stocks edged lower as traders returned from the Golden Week holidays, with tourism data trailing some expectations and global uncertainties denting sentiment.The CSI 300 Index dropped as much as 1.3% on Monday, its first trading session in more than a week, before paring more than half of the losses.

Chinese equities are weighed by “a bit of negatives from couples of aspects” that include a slight miss in holiday spending numbers and the conflict in Israel, said Willer Chen, senior research analyst at Forsyth Barr Asia Ltd. Overall, pessimism towards Chinese markets remains prevalent, with the CSI 300 Index down more than 5% this year and heading close to erasing all its gains from the reopening rally that took off in October 2022.

U.S. stock futures slid in Asia on Monday as the military conflict in the Middle East boosted oil and Treasuries, while the sizzling September U.S. jobs report raised the rate stakes for inflation figures later in the week. Holidays in Japan and South Korea made for thin conditions but the initial bid was for bonds and the safe harbours of Japanese yen and gold, with the euro the main loser.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

China Stocks Slide as Traders Return From Golden Week Break - BNN BloombergChinese stocks fell as traders returned from the Golden Week holidays, with tourism data trailing some expectations and global uncertainties denting sentiment.

China Stocks Slide as Traders Return From Golden Week Break - BNN BloombergChinese stocks fell as traders returned from the Golden Week holidays, with tourism data trailing some expectations and global uncertainties denting sentiment.

Read more »