The third quarter of 2023 extended the crypto market’s low volatility era, which began in the final months of Q2. Barring intermittent bouts, the sector failed to show sustained price movements in either direction, frustrating both market bulls and bears.published by crypto market data provider Kaiko, the 90-day historical volatility plunged to multi-year lows in September.

The SEC has a maximum of 240 days to approve or deny an ETF from the date of the filing. This meant that the regulator would reserve its verdict until at least January 2024. As per the report, liquidity in the market became more concentrated. Just eight trading platforms were responsible for 90% of global market depth and trading volumes. Infact, Binance alone accounted for more than 30% of market liquidity.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

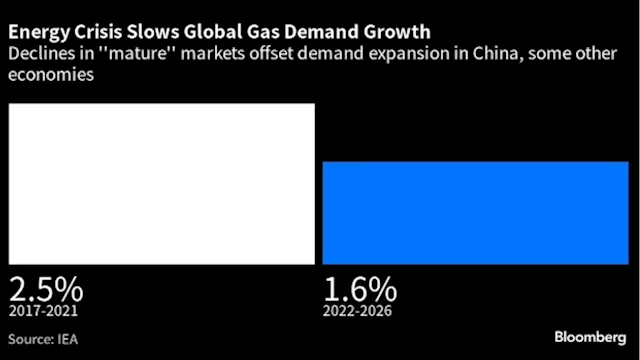

Tight Supplies, Cold May Boost Gas Market Volatility, IEA Says - BNN BloombergGlobal natural gas supplies remain tight, even with recent reductions in demand, so especially frigid weather this heating season raises the threat of more price swings, the International Energy Agency said.

Tight Supplies, Cold May Boost Gas Market Volatility, IEA Says - BNN BloombergGlobal natural gas supplies remain tight, even with recent reductions in demand, so especially frigid weather this heating season raises the threat of more price swings, the International Energy Agency said.

Read more »