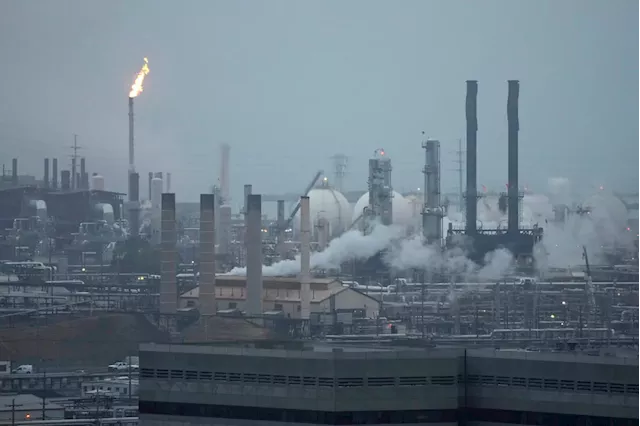

-- Exxon Mobil Corp. and Chevron Corp. spent recent days telling investors why they want to spend $114 billion combined on two megadeals. On Friday, their earnings reports revealed why they need to.Israel Enters ‘New Stage’ of War With Gaza Ground Fighting

Unlike their European rivals, Exxon and Chevron have invested heavily in fossil fuels through the ESG boom of the last four years. Even so, new crude supplies have been hard to come by. Out at sea, exploration is expensive and unpredictable. US shale fields are experiencing declining production growth as the best acreage has been already fracked.

Chevron revealed yet another delay and cost overrun at its $45 billion Tengiz project in Kazakhstan, and that Tengiz’s cash flow will be about $1 billion less than previously forecast when it finally comes online in 2025. “The industry is still recovering from the impact of the pandemic, and the lower levels of capital that have been going in across the industry to offset the depletion that’s been happening,” Exxon Chief Executive Officer Darren Woods said in an interview on Bloomberg TV.

Fixing such problems will likely add to costs. The global oil and gas industry is expected to boost spending about 10% this year to $545 billion, according to JPMorgan Chase & Co., on top of a 34% hike last year. Earlier this week, Halliburton Co. CEO Jeff Miller reminded investors of what has long been one of the industry’s biggest challenges, particularly in shale.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Chevron & Exxon earnings, September PCE: What to WatchYahoo Finance Live co-host Julie Hyman breaks down what investors should pay attention to for Friday, October 27, including earnings expected out from energy...

Chevron & Exxon earnings, September PCE: What to WatchYahoo Finance Live co-host Julie Hyman breaks down what investors should pay attention to for Friday, October 27, including earnings expected out from energy...

Read more »

Wall Street eyes Big Oil's deal upsides despite Chevron, Exxon earnings missesSuper oil majors Exxon and Chevron missed on quarterly results, but Wall Street analysts are more focused on the long game after both companies recently...

Wall Street eyes Big Oil's deal upsides despite Chevron, Exxon earnings missesSuper oil majors Exxon and Chevron missed on quarterly results, but Wall Street analysts are more focused on the long game after both companies recently...

Read more »

Corus Entertainment says advertising revenue declined as company reports fourth-quarter earningsCorus says its profits amounted to 25 cents per diluted share for the quarter ended Aug. 31, compared with a loss of $1.82 per diluted share in the same quarter last year

Corus Entertainment says advertising revenue declined as company reports fourth-quarter earningsCorus says its profits amounted to 25 cents per diluted share for the quarter ended Aug. 31, compared with a loss of $1.82 per diluted share in the same quarter last year

Read more »

Corus Entertainment says advertising revenue declines as company reports Q4 earningsCorus Entertainment Inc. reported a net income attributable to shareholders of $50.4 million in its latest quarter, a turnaround from its net loss of $367.1 million in the fourth quarter of last year.

Corus Entertainment says advertising revenue declines as company reports Q4 earningsCorus Entertainment Inc. reported a net income attributable to shareholders of $50.4 million in its latest quarter, a turnaround from its net loss of $367.1 million in the fourth quarter of last year.

Read more »