This could be a good time for investors to pour money into stocks of companies involved in the production of oil and natural gas. And the best reason for that may have nothing to do with military conflict.

“Peak demand season for oil and gasoline is over by Labor Day. Typically we build inventory from October to the end of the first quarter or middle of the second quarter,” he said.With no way of predicting whether Iran will become more directly involved in hostilities, which might disrupt its oil exports and cause oil prices to shoot up, investors might be better off counting on weak seasonal demand to set up good buying opportunities.

Wong continued, saying that there were potential targets among publicly traded operators in the Permian Basin, in western Texas and southeast New Mexico. Pioneer is a major operator there. Other potential targets focused in that shale basin that Wong named are Callon Petroleum Co. CPE, -3.34%, Permian Resources Corp. PR, -5.59%, Diamondback Energy Inc. FANG, -1.80%, Vital Energy Inc. VTLE, -4.61% and SM Energy Co. SM, -3.55%.

Let’s screen these 70 companies three ways. First, we will screen price/book value ratios. Then we will screen for trailing free-cash-flow yields. Then, for the companies for which consensus estimates are available, we will look at forward free-cash-flow yields.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

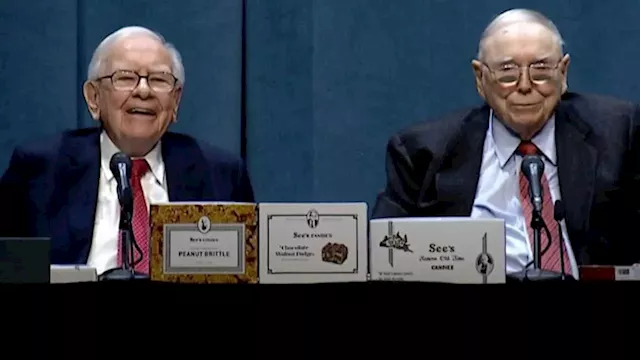

Warren Buffett has been selling stocks including Chevron and hoarding a record level of cashThanks to a surge in bond yields, Berkshire's cash, which was mainly parked in short-term Treasury bills, grew to a record level of $157.2 billion.

Warren Buffett has been selling stocks including Chevron and hoarding a record level of cashThanks to a surge in bond yields, Berkshire's cash, which was mainly parked in short-term Treasury bills, grew to a record level of $157.2 billion.

Read more »