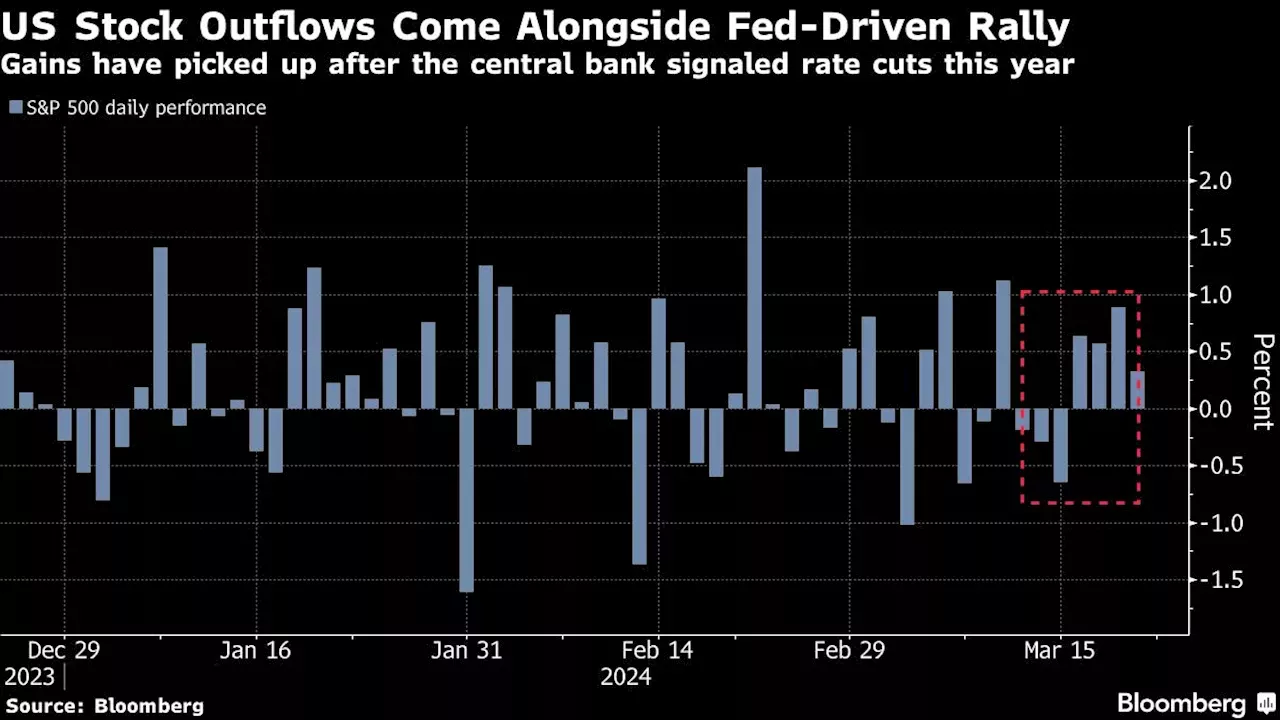

-- US stocks saw hefty outflows in the runup to the Federal Reserve’s policy meeting that took the S&P 500 Index to fresh all-time highs.What Happens If Trump Can’t Post His $454 Million BondUS equity funds suffered redemptions of about $22 billion in the week through Wednesday — the biggest since December 2022, according to a note from Bank of America Corp., citing EPFR Global data. That’s alongside a 1.

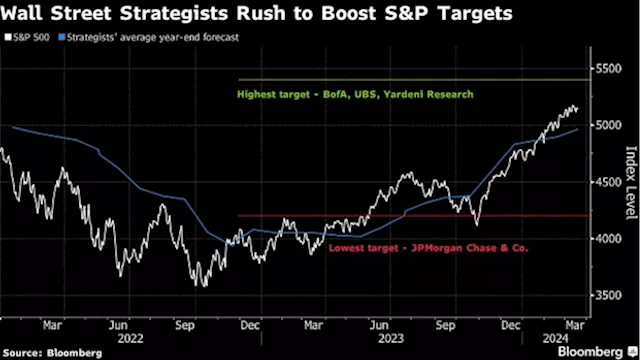

Bank of America strategist Michael Hartnett, on the other hand, has warned that the gains are indicative of a bubble. The strategist had remained bearish on stocks last year despite a sharp rally in the S&P 500. Among other highlights from the note, cash funds posted outflows of over $61 billion, the most since October. Global bond funds registered inflows of $5.4 billion.5 tax changes to watch out for in the upcoming federal budgetKey Insights Using the 2 Stage Free Cash Flow to Equity, Enbridge fair value estimate is CA$85.32 Current share price...

Granite REIT is yielding a generous 4.37% and is just one of three quality Canadian REITs worth buying right now. The post The Top Canadian REITs to Buy in March 2024 appeared first on The Motley Fool Canada.Do you have a long investment horizon and don't mind being patient? This safe and steady growth stock could really deliver in the years ahead. The post 1 TSX Stocks to Buy in 2024 and Hold for the Next 10 Years appeared first on The Motley Fool Canada.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bullish investors pile into EM, European stocks in March, BofA survey showsUpbeat investors rushed into emerging market equities in March at the fastest pace since April 2017, and into euro zone stocks at the quickest clip since...

Bullish investors pile into EM, European stocks in March, BofA survey showsUpbeat investors rushed into emerging market equities in March at the fastest pace since April 2017, and into euro zone stocks at the quickest clip since...

Read more »

BofA Survey Shows Risk-On Rotation Out of US Tech Into European StocksInvestors are in a risk-on mood, and are snapping up stocks in Europe and emerging markets at the expense of the US and the technology sector, according to Bank of America Corp.’s latest fund manager survey.

BofA Survey Shows Risk-On Rotation Out of US Tech Into European StocksInvestors are in a risk-on mood, and are snapping up stocks in Europe and emerging markets at the expense of the US and the technology sector, according to Bank of America Corp.’s latest fund manager survey.

Read more »

BofA Strategists at Odds Over Presence of ‘Euphoria’ in StocksWall Street is so divided on whether the US stock market’s meteoric rise has gone too far, too fast that even Bank of America Corp.’s own strategists disagree.

BofA Strategists at Odds Over Presence of ‘Euphoria’ in StocksWall Street is so divided on whether the US stock market’s meteoric rise has gone too far, too fast that even Bank of America Corp.’s own strategists disagree.

Read more »

Markets today: U.S. stocks suffer 'heat check' as rally hits a wallWall Street traders sent stocks sliding on speculation that a rally to multiple records this year is now overdone.

Markets today: U.S. stocks suffer 'heat check' as rally hits a wallWall Street traders sent stocks sliding on speculation that a rally to multiple records this year is now overdone.

Read more »

Hedge funds buy largest bulk of bank stocks in a year, Goldman saysHedge funds piled into bank and financials stocks at the fastest pace in a year, Goldman Sachs said in a note, just in time to catch highs seen European and ...

Hedge funds buy largest bulk of bank stocks in a year, Goldman saysHedge funds piled into bank and financials stocks at the fastest pace in a year, Goldman Sachs said in a note, just in time to catch highs seen European and ...

Read more »