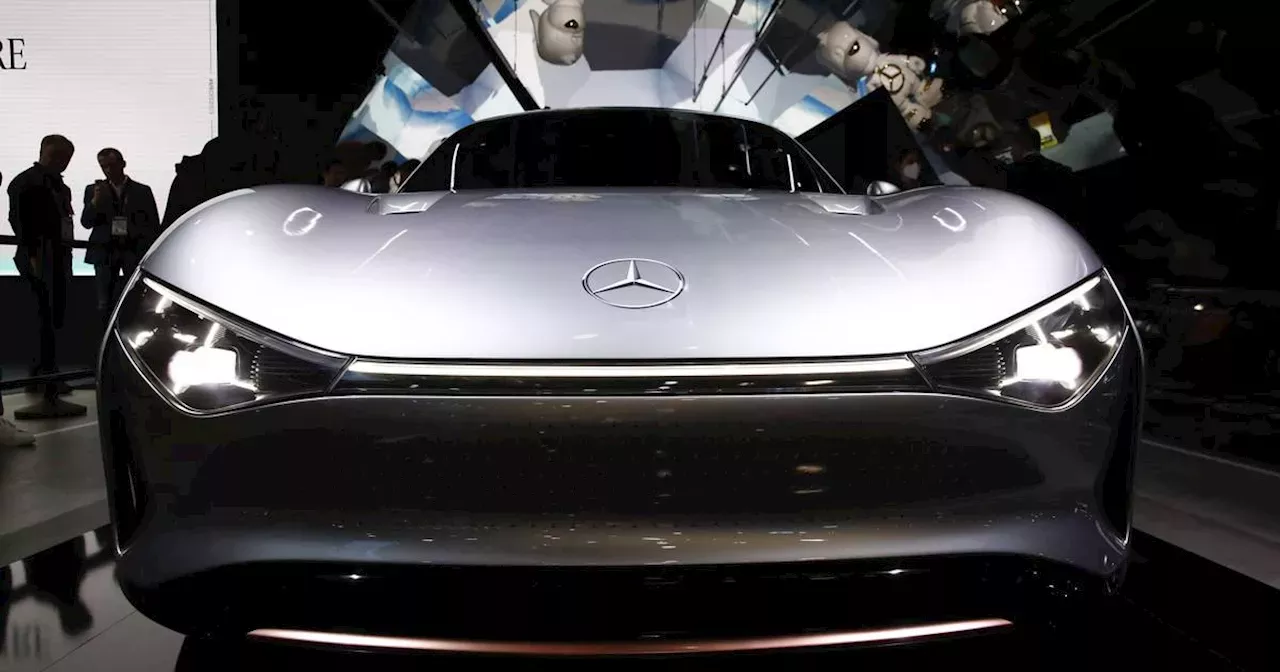

Mercedes-Benz's Vision EQXX concept car, an electric vehicle that proposes to drive 745 miles on one charge. UK employers are increasingly allowing staff to lease electric vehicles for their personal use through salary sacrifice schemes, which means they can make big tax and national insurance savings.In decades past, the company car was a symbol of professional status, prized by employees as a visible marker of seniority.

Increasingly popular are leasing and personal contract plan pay-monthly schemes, through which motorists finance the value a vehicle loses over three or so years rather than the total cost of the car. Some of the most popular take-up of salary sacrifice schemes has been in the public sector, particularly the NHS

A salary sacrifice scheme allows an employee to deduct a monthly sum from their gross pay – so before tax and national insurance – to cover the cost of leasing the car. This reduces their taxable salary so cuts the amount of tax and insurance they pay. The UK government introduced a 0 per cent BIK rate for EVs in 2020 to encourage take-up through work schemes for one year. The 2 per cent BIK rate will rise to 3 per cent in April next year, then again by a further percentage point each April until 2028.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Car makers renew investment in hybrids, as EV appetites waneSales of EVs in Ireland have dropped 14.2 per cent in the first three months of the year, even as the new car market increased overall

Car makers renew investment in hybrids, as EV appetites waneSales of EVs in Ireland have dropped 14.2 per cent in the first three months of the year, even as the new car market increased overall

Read more »