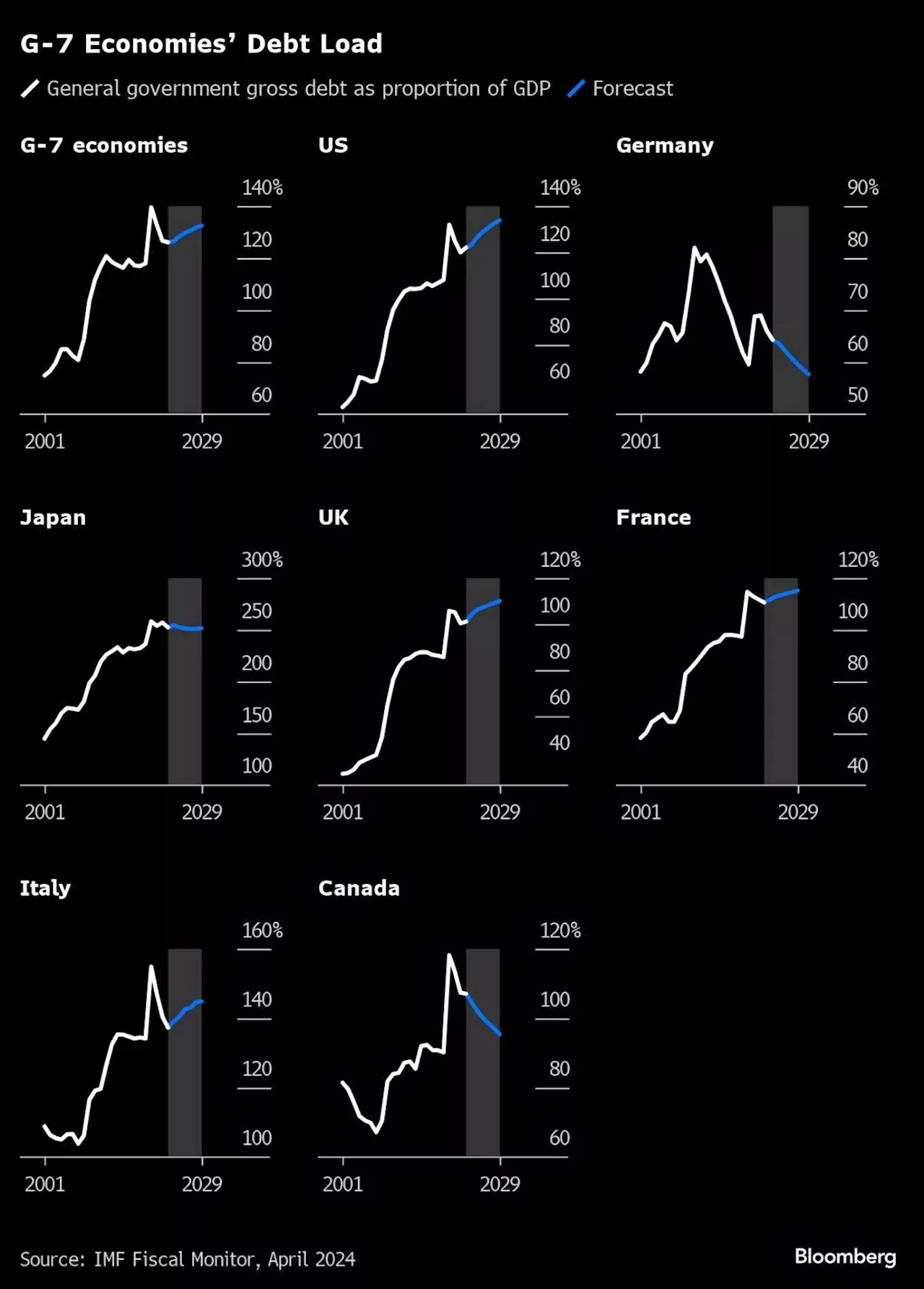

Despite a trajectory of rising borrowings and the International Monetary Fund’s declaration last month that “now is the time” to restore sustainable budget policies, that subject doesn’t appear on the formal agenda for G-7 central bankers and finance ministers set to gather in the lakeside town of Stresa.The topic’s sensitivity isn’t surprising given looming electoral tests in the US, UK and European Union — and a precarious fiscal situation in Italy, the host nation.

Scope Ratings last week predicted that Italy will have Europe’s biggest pile of borrowings in just three years, and on Monday, the IMF issued an annual assessment calling for “faster-than-planned” action. “If you have a lot of debt, you’re going to run into problems,” said Rob Burrows, a portfolio manager at M&G Investments. “It’s one of those issues that keeps me up at night, with me thinking, how will we get out of this?”

“Substantial additional efforts, compared to staff’s current policy baseline, will be needed over the medium-term, starting in 2024, to strengthen public finance,” the fund said about France on Thursday. Reticence to discuss fiscal challenges isn’t restricted to the G-7. Its larger equivalent, the Group of 20, avoided the matter with intent when meeting in February, after objections by China for a mention in their meeting statement.

The US economy is in a 'selective recession' as lower-income consumers can't cover the cost of living, JPMorgan says

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Finance Chiefs at Lakeside Look Away From Looming Debt MountainGlobal finance chiefs meeting in the shadow of the Italian alps this week probably won’t look too hard at one of the biggest mountains in the foreground: their own debt.

Finance Chiefs at Lakeside Look Away From Looming Debt MountainGlobal finance chiefs meeting in the shadow of the Italian alps this week probably won’t look too hard at one of the biggest mountains in the foreground: their own debt.

Read more »

Zimbabwe to Extend ZiG Currency Crackdown to Companies, Finance Chief SaysZimbabwe plans to extend a crackdown that’s targeting street currency traders to companies to ensure goods and services are priced using only the official exchange rate of the new ZiG currency.

Zimbabwe to Extend ZiG Currency Crackdown to Companies, Finance Chief SaysZimbabwe plans to extend a crackdown that’s targeting street currency traders to companies to ensure goods and services are priced using only the official exchange rate of the new ZiG currency.

Read more »

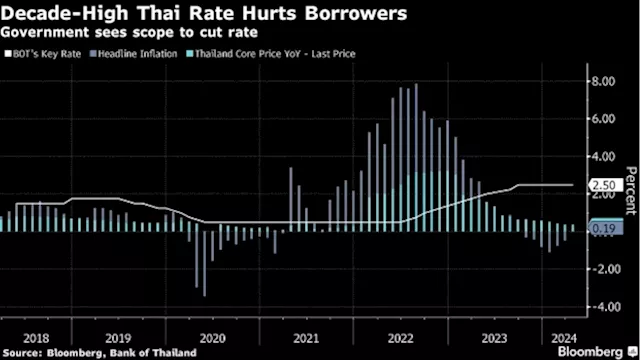

Thai Finance Chief Bats for Loan Access in Absence of Rate CutThailand’s new Finance Minister Pichai Chunhavajira urged the central bank to improve access to credit for retail borrowers and small business, while reiterating the need to synchronize fiscal and monetary policies to support Southeast Asia’s second-largest economy.

Thai Finance Chief Bats for Loan Access in Absence of Rate CutThailand’s new Finance Minister Pichai Chunhavajira urged the central bank to improve access to credit for retail borrowers and small business, while reiterating the need to synchronize fiscal and monetary policies to support Southeast Asia’s second-largest economy.

Read more »

New Thai Finance Chief Wants Monetary, Fiscal Policies AlignedThailand’s new Finance Minister Pichai Chunhavajira has urged the central bank to support government policies in sign that he will bat for lower interest rates just like his predecessor, the prime minister.

New Thai Finance Chief Wants Monetary, Fiscal Policies AlignedThailand’s new Finance Minister Pichai Chunhavajira has urged the central bank to support government policies in sign that he will bat for lower interest rates just like his predecessor, the prime minister.

Read more »

Lufthansa Names Streichert From Amadeus as Next Finance ChiefDeutsche Lufthansa AG named Till Streichert as chief financial officer to succeed Remco Steenbergen, who announced his surprise departure a few months ago as part of a broader management overhaul.

Lufthansa Names Streichert From Amadeus as Next Finance ChiefDeutsche Lufthansa AG named Till Streichert as chief financial officer to succeed Remco Steenbergen, who announced his surprise departure a few months ago as part of a broader management overhaul.

Read more »

Zimbabwe Seeks Full Convertibility of ZiG Currency, Finance Chief SaysZimbabwe will seek full convertibility of its new currency, the ZiG, as a way to further support the unit and protect it from collapse, according to Mthuli Ncube, the Finance Minister.

Zimbabwe Seeks Full Convertibility of ZiG Currency, Finance Chief SaysZimbabwe will seek full convertibility of its new currency, the ZiG, as a way to further support the unit and protect it from collapse, according to Mthuli Ncube, the Finance Minister.

Read more »