Energy Hedge Funds Stung by Low Volatility in Sleepy Oil Market4 of the worst pieces of advice from the investment industryMortgage lending among top risks facing financial system: OSFI'Sell in May and go away' makes less sense as technicals point to summer rallyYoung investors more likely to switch advisers, citing high fees: J.D. Power surveyInflation, cost of living hurting education savings plans: surveyInsurance is high on frequently stolen vehicles.

Here's how to fix it, according to RBCHere are the key takeaways from Bank of Canada's rate-cut decisionTraders gird for weaker Canadian dollar as first rate cut eyedBank of Canada likely to cut rates: BermanRed tape and delays are holding back Canada’s productivity, Poloz and Manley sayStatistics Canada says economy grew at 1.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

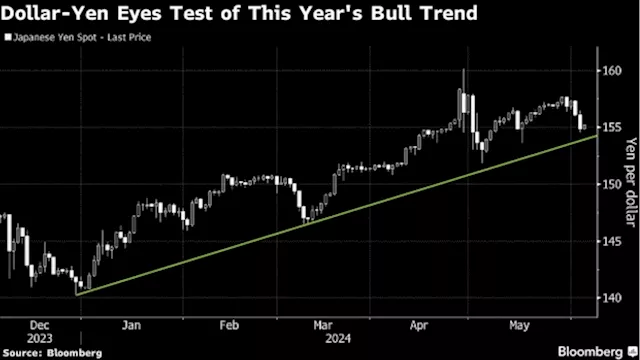

Hedge Funds Flip Flop on Yen Option Trade as BOJ ‘Spooks’ MarketHedge funds are backpedaling on yen option trades with a sudden spate of bullish bets on the currency, according to market participants.

Hedge Funds Flip Flop on Yen Option Trade as BOJ ‘Spooks’ MarketHedge funds are backpedaling on yen option trades with a sudden spate of bullish bets on the currency, according to market participants.

Read more »

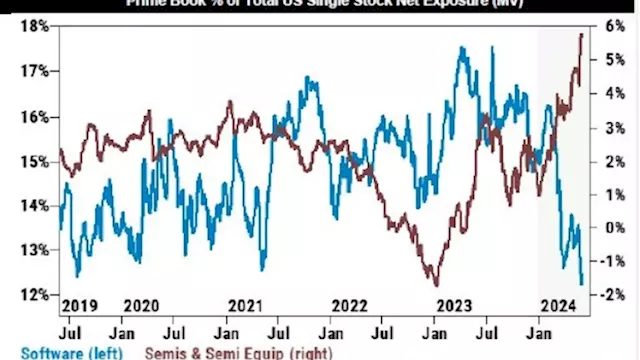

Hedge Funds Sell Software Stocks as AI Splits Tech, Goldman SaysHedge funds are unloading software stocks as concerns mount about who’ll be left behind in the artificial intelligence boom.

Hedge Funds Sell Software Stocks as AI Splits Tech, Goldman SaysHedge funds are unloading software stocks as concerns mount about who’ll be left behind in the artificial intelligence boom.

Read more »