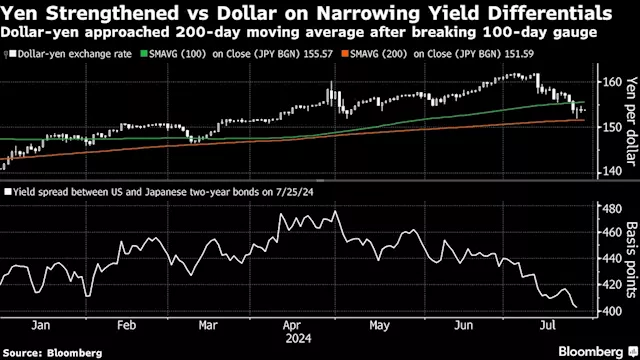

NEW YORK/LONDON, July 31 - MSCI'S global equities index rallied on Wednesday while the yen jumped after the Bank of Japan raised interest rates and investors waited for a U.S. interest rate decision from the Federal Reserve.

In U.S. Treasuries, yields were mostly lower after economic data indicated a slowing in the labor market and wage growth cemented expectations for a rate cut signal from the Fed. "We're seeing a nice bounce this morning. A lot of it is being driven by tech," said Emily Roland, Co-Chief Investment Strategist at John Hancock Investment Management. For tech strength, Roland pointed to earnings commentary as well as a report that a Biden administration plan restricting exports of chip manufacturing equipment to China would exclude shipments from allies that export key chip making equipment - including Japan, the Netherlands and South Korea.

MSCI's gauge of stocks across the globe , rose 13.34 points, or 1.66%, to 814.74. Europe's STOXX 600 , index rose 0.79% to 518.14. "This upside surprise is giving the yen a huge boost, especially because people think that the Fed might start telegraphing this afternoon for a cut in September," Given said.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Stocks rise, yen gains as BOJ hikes rates; Fed in focusThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Stocks rise, yen gains as BOJ hikes rates; Fed in focusThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Source: KitcoNewsNOW - 🏆 13. / 78 Read more »

Asian Stocks Eye Early Gains Into BOJ, Fed Week: Markets Wrap(Bloomberg) -- Asian stocks are poised to rise in early trading ahead of a week of key central bank decisions in Japan, US and UK, as well as some big tech...

Asian Stocks Eye Early Gains Into BOJ, Fed Week: Markets Wrap(Bloomberg) -- Asian stocks are poised to rise in early trading ahead of a week of key central bank decisions in Japan, US and UK, as well as some big tech...

Source: YahooFinanceCA - 🏆 47. / 63 Read more »

Oil slips, Asia stocks dip ahead of Fed, BOJOil traded near seven-week lows on Tuesday as a softening demand outlook weighed on commodities, while bond, currency and stock markets traded cautiously...

Oil slips, Asia stocks dip ahead of Fed, BOJOil traded near seven-week lows on Tuesday as a softening demand outlook weighed on commodities, while bond, currency and stock markets traded cautiously...

Source: YahooFinanceCA - 🏆 47. / 63 Read more »

Premarket: Commodities fall, stocks steady ahead of Fed, BOJ rate decisionsThe S&P 500 has steadied after a two-week downturn and futures were flat

Premarket: Commodities fall, stocks steady ahead of Fed, BOJ rate decisionsThe S&P 500 has steadied after a two-week downturn and futures were flat

Source: globeandmail - 🏆 5. / 92 Read more »

Commodities fall, stocks nervy ahead of Fed, BOJ rate decisionsThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Commodities fall, stocks nervy ahead of Fed, BOJ rate decisionsThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Source: KitcoNewsNOW - 🏆 13. / 78 Read more »

Premarket: Stocks rise, yen gains after BOJ hikes ratesInvestors prepare for U.S. Fed decision

Premarket: Stocks rise, yen gains after BOJ hikes ratesInvestors prepare for U.S. Fed decision

Source: globeandmail - 🏆 5. / 92 Read more »