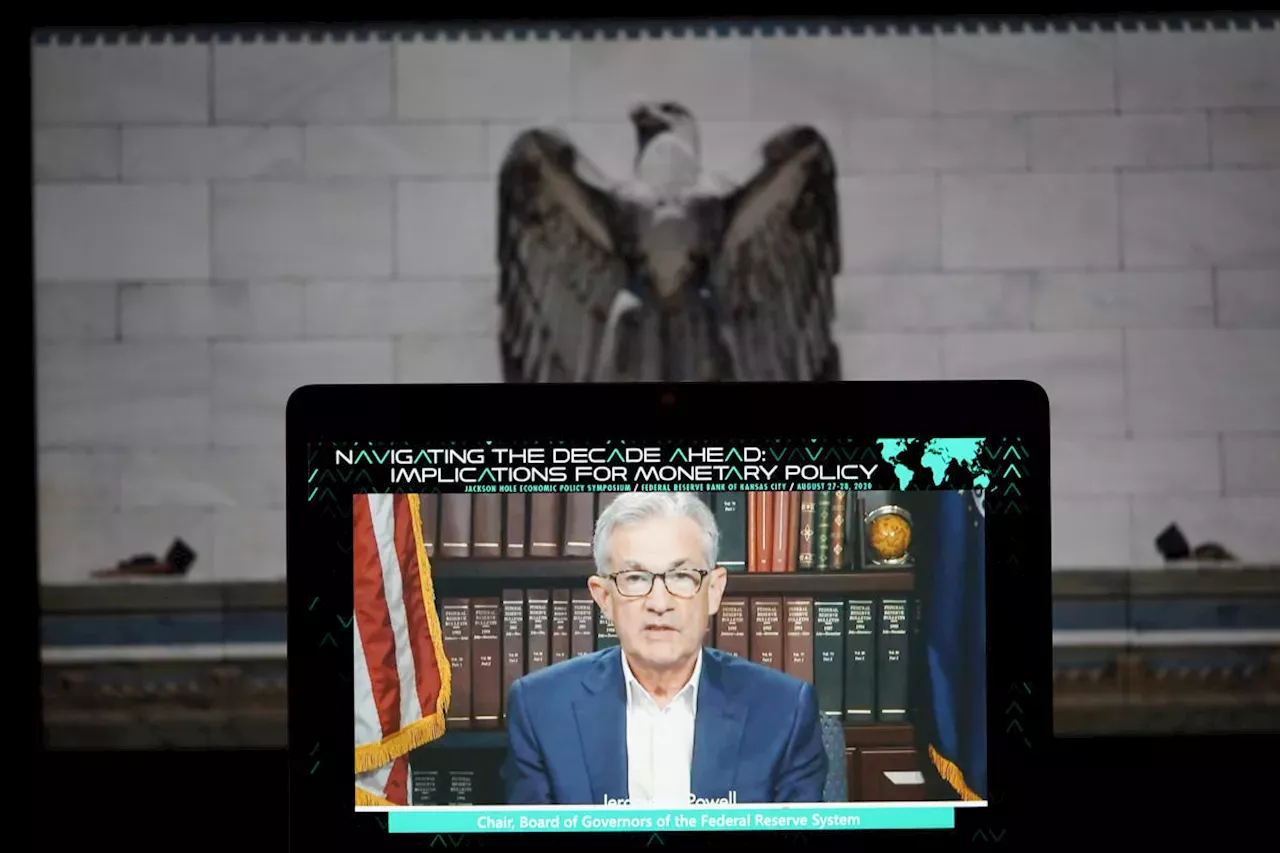

In the week ahead, a quiet week on the economic calendar will shift the market focus to the Federal Reserve as Chair Jerome Powell is expected to speak Friday morning at the Jackson Hole Symposium. Investors will be closely listening for hints on when, and how much, the Fed plans to cut interest rates in 2024.A busy economic data week played a pivotal role in the stock rebound this week.

"The easiest thing for Chair Powell to do would be to repeat his message from July," Gapen wrote. "An evolution of the July FOMC language would suggest the committee is 'very close' or 'close' to the point where easing is likely to occur. A more dovish signal could be a statement that the committee wants to avoid 'unexpected weakness' in the labor market, rather than simply responding to it after it occurs.

"With the market pullback, especially the more aggressive pullback on the growth side of the market, sentiment looks much more balanced now than it did heading into this month," Citi US equity strategy director Drew Pettit told Yahoo Finance. Millennials Are Sharing The 'Older Person' Hills They'll Die On, And Boomers May Have A Point About TheseMicrowaves offer convenience at the push of a button, but that can also make it exceedingly easy to commit a risky kitchen mistake. Here's how.Calgary pipe woes flag 'dire need' for infrastructure upgrades: municipalities group

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold prices outperform in July, but Jackson Hole, market volatility and election noise create August risksThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Gold prices outperform in July, but Jackson Hole, market volatility and election noise create August risksThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Source: KitcoNewsNOW - 🏆 13. / 78 Read more »

Fed responds to economic data, not politics or stocks, says Chicago Fed's GoolsbeeChicago Federal Reserve Bank President Austan Goolsbee on Thursday reiterated that the central bank's job is not to respond to stock market routs or...

Fed responds to economic data, not politics or stocks, says Chicago Fed's GoolsbeeChicago Federal Reserve Bank President Austan Goolsbee on Thursday reiterated that the central bank's job is not to respond to stock market routs or...

Source: YahooFinanceCA - 🏆 47. / 63 Read more »