The market value of on-chain real-world assets , excluding stablecoins, continues to rise, representing continued investor interest in blockchain-based tokenization of traditional assets.Tokenization of RWAs like real estate, government bonds, stocks, and intangible assets like carbon credits makes traditionally illiquid markets easier to trade, allowing investors to purchase assets in fractions while facilitating clear records and streamlining the settlement process.

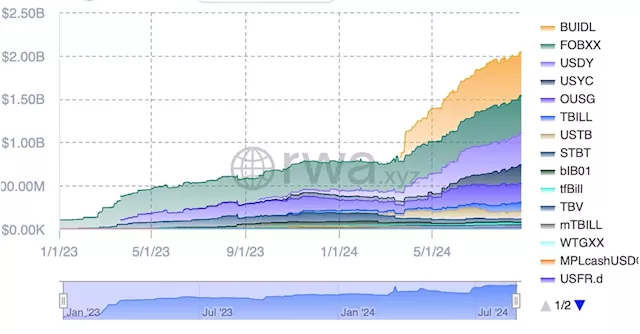

Tokenized treasury funds, digital representations of the U.S. Treasury notes, have surpassed $2.2 billion in market value, with BlackRock's BUILD boasting nearly $520 million. With a market cap of $434 million, Franklin Templeton's FBOXX is the second-largest tokenized Treasury product. "This growth has likely been impacted by U.S. interest rates being at a 23-year high, with the federal funds target rate having been held steady at 5.25%-5.5% since July 2023. This has made the US government-backed yield of Treasuries an attractive investment vehicle for many investors," analysts at Binance Research said in the report.

Per Binance Research, sizeable rate reductions may be needed to weaken the demand for tokenized Treasuries materially.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Avalanche Becomes Latest Blockchain to Support Franklin Templeton's Tokenized Money Market FundHelene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk's Markets Daily show. Helene is a graduate of New York University's business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Avalanche Becomes Latest Blockchain to Support Franklin Templeton's Tokenized Money Market FundHelene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk's Markets Daily show. Helene is a graduate of New York University's business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Source: CoinDesk - 🏆 291. / 63 Read more »

Tokenized Treasury Funds Pass $2B Market Cap Amid BlackRock’s Explosive GrowthHelene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk's Markets Daily show. Helene is a graduate of New York University's business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Tokenized Treasury Funds Pass $2B Market Cap Amid BlackRock’s Explosive GrowthHelene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk's Markets Daily show. Helene is a graduate of New York University's business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Source: CoinDesk - 🏆 291. / 63 Read more »