Stocks roared higher in a delayed relief rally on Thursday, following the Federal Reserve's jumbo-sized interest rate cut Wednesday, but rocky times may be ahead – and investors will want to prepare for that volatility. Excitement over the central bank's half-point rate cut lifted the S & P 500 over the 5,700 threshold for the first time ever on Thursday. However, Goldman Sachs warns that investors should buckle up for a potential bumpy ride in the market.

Bulk up on bonds Even as the Fed has lowered rates, bonds are still offering attractive yields – "more so than they did in the prior 10 years when rates were near zero," Hasan said. And they've been a good buy for clients who are nearing retirement, seeking income and appreciate bonds' ability to offset stocks' volatility. For higher-income clients, she likes municipal bonds, which offer tax-exempt income on a federal level.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

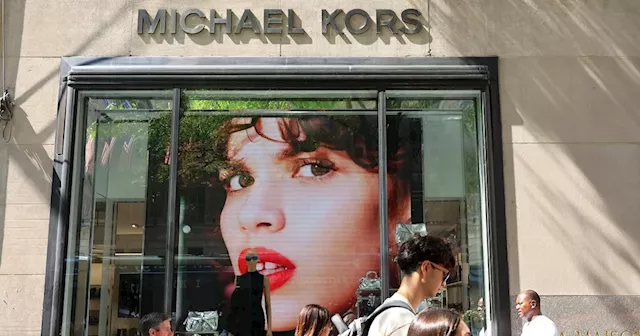

Michael Kors Testifies to Fashion Industry's Volatility in Tapestry-Capri Merger TrialIn a federal antitrust trial, Michael Kors, founder and chief creative director of his namesake brand, spoke about the challenges of staying relevant in the ever-changing fashion landscape. He testified as part of the FTC's lawsuit seeking to block Tapestry’s $8.5 billion acquisition of Capri, which would create a major fashion conglomerate.

Michael Kors Testifies to Fashion Industry's Volatility in Tapestry-Capri Merger TrialIn a federal antitrust trial, Michael Kors, founder and chief creative director of his namesake brand, spoke about the challenges of staying relevant in the ever-changing fashion landscape. He testified as part of the FTC's lawsuit seeking to block Tapestry’s $8.5 billion acquisition of Capri, which would create a major fashion conglomerate.

Source: NBCNews - 🏆 10. / 86 Read more »

What to own in the stock market as volatility returnsWhat to own in the stock market as volatility returns

What to own in the stock market as volatility returnsWhat to own in the stock market as volatility returns

Source: Investingcom - 🏆 450. / 53 Read more »