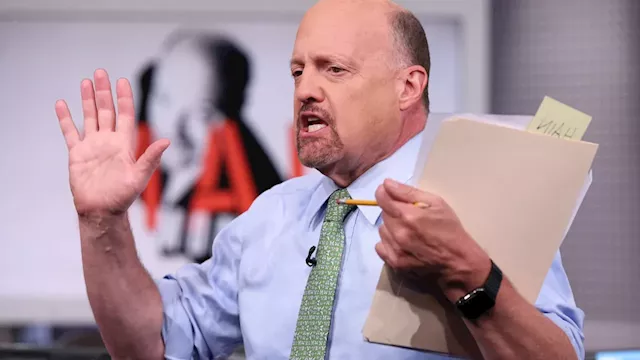

CNBC's Jim Cramer on Tuesday lamented rising bond yields' effect on the market, saying this action could narrow the rally to tech and diminish broader sector gains.

"If the bond market doesn't start behaving, or at least calming down, if longer-term interest rates don't stop going up, we're going to start losing the groups that have led us higher for months now," he said.on Tuesday lamented rising bond yields' effect on the market, saying this action could narrow the rally to tech and diminish broader sector gains.

"If the bond market doesn't start behaving, or at least calming down, if longer-term interest rates don't stop going up, we're going to start losing the groups that have led us higher for months now," he said. Some on Wall Street were expecting bond yields to decline after the Federal Reserve issued a hefty 50-basis-point cut and indicated there would be more to come over the next several months. The bond market and the stock market usually show a negative correlation, with investors flocking to the latter when rates are low and the economy is roaring while piling into the former when rates are high and bonds seem safer than equities.

Cramer said investors are drawn back to tech stocks as higher rates complicate the growth narratives for economically sensitive corners of the market. In recent months, investors were hoping that lower borrowing costs would help companies — such as those in the industrial sector and other housing-related areas — see an increase in business and, by extension, their stock prices.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Jim Cramer says strong jobs report suggests no imminent recession — and that's good for stocksThe U.S. economy may not have a landing at all, CNBC's Jim Cramer said Friday.

Jim Cramer says strong jobs report suggests no imminent recession — and that's good for stocksThe U.S. economy may not have a landing at all, CNBC's Jim Cramer said Friday.

Source: CNBC - 🏆 12. / 72 Read more »

Jim Cramer's week ahead: CPI data and earnings from Delta, Domino's and major banksCNBC's Jim Cramer reviewed next week's top market-moving action.

Jim Cramer's week ahead: CPI data and earnings from Delta, Domino's and major banksCNBC's Jim Cramer reviewed next week's top market-moving action.

Source: CNBC - 🏆 12. / 72 Read more »

Jim Cramer's top 10 things to watch in the stock market TuesdayWall Street was headed for a higher open Tuesday after the S&P 500 had its worst session in a month.

Jim Cramer's top 10 things to watch in the stock market TuesdayWall Street was headed for a higher open Tuesday after the S&P 500 had its worst session in a month.

Source: CNBC - 🏆 12. / 72 Read more »

Jim Cramer says to focus more on earnings than inflation data with Fed in a cutting cycleCNBC's Jim Cramer on Thursday told investors not to fixate on the consumer price index.

Jim Cramer says to focus more on earnings than inflation data with Fed in a cutting cycleCNBC's Jim Cramer on Thursday told investors not to fixate on the consumer price index.

Source: CNBC - 🏆 12. / 72 Read more »

Jim Cramer's top 10 things to watch in the stock market TuesdayWall Street was under pressure Tuesday after a down day to start the week.

Jim Cramer's top 10 things to watch in the stock market TuesdayWall Street was under pressure Tuesday after a down day to start the week.

Source: CNBC - 🏆 12. / 72 Read more »