) soared after it raised its annual core profit forecast on Friday, as the country’s largest carrier benefits from strong demand for international travel and lower jet fuel prices.

The repurchase aims to address the dilution that occurred due to its financing needs during the pandemic, it said. The carrier now expects its 2024 adjusted earnings before interest, taxes, depreciation and amortization of about $3.5-billion, compared with its previous forecast of $3.1-billion to $3.4-billion.

Magna had benefited from a healthy flow of orders, with automakers ramping up production over the years, however, that pace has slowed as companies readjust their inventory levels to match demand. Magna now expects annual total sales between $42.2-billion and $43.2-billion, compared with its prior forecast range of $42.5-billion to $44.1-billion.

However in the United States, higher output countered weakness in the pricing environment as well as refining margins, with both Exxon, Imperial’s majority shareholder, and Chevron reporting a profit beat earlier in the day. The Canadian pipeline operator had closed a $14-billion acquisition, including debt, of three Dominion Energy utilities — East Ohio Gas, Questar Gas and Public Service Co of North Carolina — by the third quarter.

“In liquids, demand for the Mainline remains strong and our volumes for 2024 are expected to exceed 3 million barrels per day,” said CEO Greg Ebel. Amazon’s upbeat results could signal a better-than-feared holiday season for retailers, who have been bracing for the slowest pace of holiday sales growth in six years.

The operating margin for Amazon’s international business jumped to 3.6 per cent in the third quarter from 0.9 per cent in the second quarter. The North America margin ticked up to 5.9 per cent from 5.6 per cent in the previous quarter. Amazon Web Services, the company’s cloud business, reported a 19-per-cent increase in sales to US$27.5-billion, in line with estimates, according to LSEG data. It was the quickest pace of growth in seven quarters for AWS, which accounts for a fifth of Amazon’s overall sales but roughly two-thirds of its revenue.

In an interview with Reuters, Intel finance chief David Zinsner said the company was “making progress” on its profitability but that it had “a lot of work to do” to achieve the targets it had set. Revenue in Intel’s Client Computing Group - which includes its PC chips for desktop and laptop computers - fell 7 per cent to US$7.3-billion. Analysts had estimated the client segment would shrink to US$7.38-billion.

“In every negotiation and strike, there is a point where we have extracted everything that we can in bargaining and by withholding our labor. We are at that point now and risk a regressive or lesser offer in the future,” the International Association of Machinists and Aerospace Workers said.Talks between the two sides were held this week with the assistance of Acting U.S. Secretary of Labor Julie Su, who praised the union and Boeing for their hard work in negotiating the deal.

The top U.S. oil producer reported income of US$8.61-billion, down from US$9.07-billion a year ago. Its US$1.92 per share profit topped Wall Street’s outlook of US$1.88 per share, on higher oil and gas production and spending constraints. The US$60-billion deal drove production in the top U.S. shale basin to nearly 1.4 million barrels per day of oil and gas, helping overcome a 17-per-cent decline in average oil prices in the quarter ended Sept. 30.

Exxon disclosed it raised its quarterly dividend by 4 per cent after generating free cash flow of US$11.3-billion, well above analysts’ estimates. Rivals Saudi Aramco and Chevron have had to borrow this year to cover shareholder returns after boosting dividends and buybacks to attract investors.) beat Wall Street estimates for third-quarter profit on Friday, helped by higher oil and gas output, but its earnings fell from a year ago.

Up to US$3-billion in cost savings are planned through 2026 from leveraging technology, asset sales and changing how and where work is performed, the company said. Operating profits were down compared to a year ago in both its major units. Earnings from pumping oil and gas fell 20 per cent to US$4.59-billion while profit from refining oil into gasoline and diesel tumbled 65 per cent, to US$595-million.) AI-enhanced iPhone made a strong start, pushing quarterly sales ahead of Wall Street expectations, but a modest revenue forecast raised questions about whether that momentum will hold over the holiday sales season.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Market movers: Stocks seeing action on FridayA survey of North American equities heading in both directions

Market movers: Stocks seeing action on FridayA survey of North American equities heading in both directions

Read more »

Stock market today: Stocks rise amid big bank earnings, inflation dataJPMorgan and Wells Fargo get earnings season going in earnest while a wholesale inflation print is in focus after the CPI surprise.

Stock market today: Stocks rise amid big bank earnings, inflation dataJPMorgan and Wells Fargo get earnings season going in earnest while a wholesale inflation print is in focus after the CPI surprise.

Read more »

Stock market today: Wall Street opens lower as Big Tech stocks pull backNEW YORK (AP) — Wall Street is feeling the downside of high expectations as Microsoft and Meta Platforms lead U.S. stock indexes lower despite delivering strong profits for the summer. The S&P 500 was down 0.

Stock market today: Wall Street opens lower as Big Tech stocks pull backNEW YORK (AP) — Wall Street is feeling the downside of high expectations as Microsoft and Meta Platforms lead U.S. stock indexes lower despite delivering strong profits for the summer. The S&P 500 was down 0.

Read more »

Stock market today: Tech leads stocks higher as oil prices retreat, China rally stallsThe focus is back on the ongoing debate over the economy and interest rates as headwinds ease.

Stock market today: Tech leads stocks higher as oil prices retreat, China rally stallsThe focus is back on the ongoing debate over the economy and interest rates as headwinds ease.

Read more »

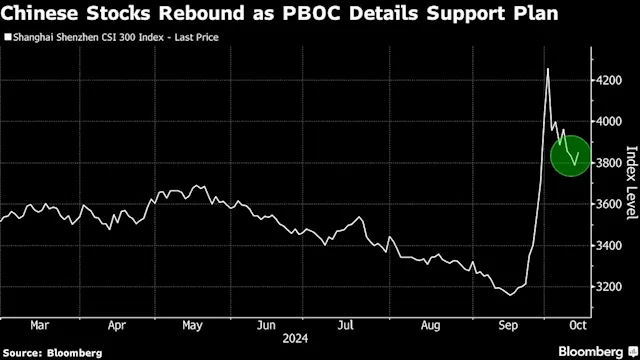

Chinese Stocks Rebound as PBOC Reinforces Support for Market(Bloomberg) -- Chinese stocks advanced on Friday following a slew of positive headlines from the central bank, which reinforced its determination to support ...

Chinese Stocks Rebound as PBOC Reinforces Support for Market(Bloomberg) -- Chinese stocks advanced on Friday following a slew of positive headlines from the central bank, which reinforced its determination to support ...

Read more »