November 06, 2024 at 2:25AM EST -- Donald Trump quickly put his stamp on financial markets as his march toward victory in the US presidential election propelled “Trump Trade” plays across assets.

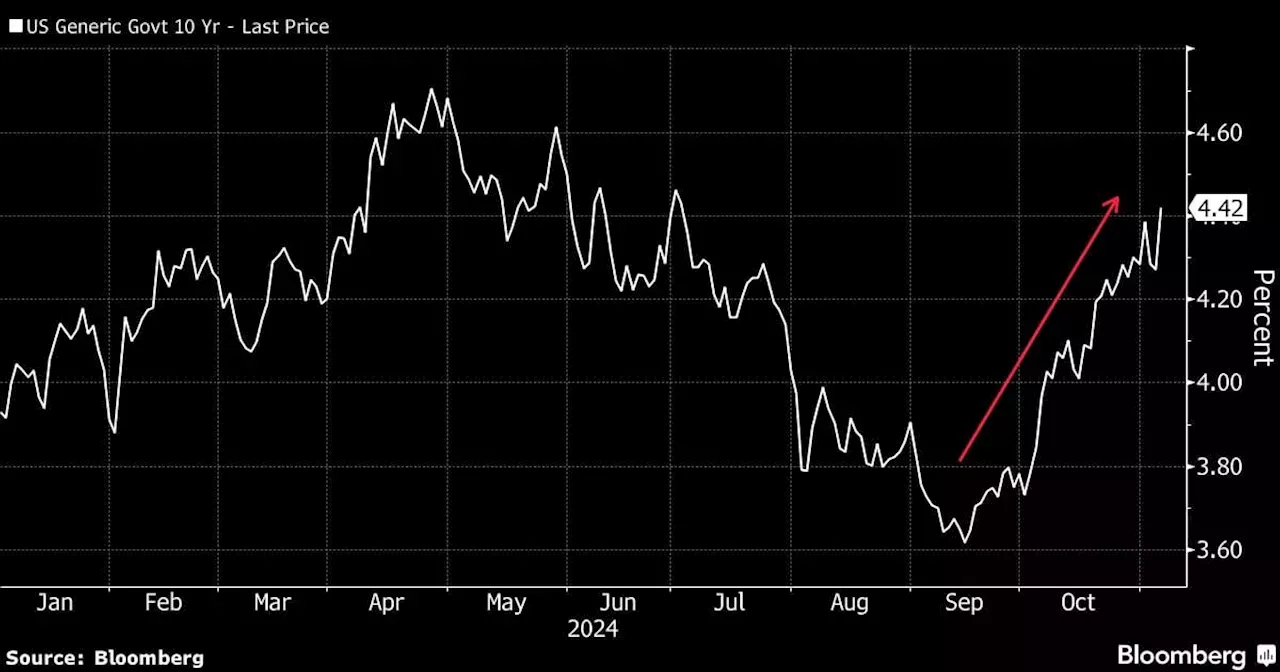

For those on Wall Street who’ve been riding the Trump Trade, and especially those who held their nerve as it wobbled on the eve of polling, it was a moment of vindication. The surge in Treasury yields underscores concerns that Trump’s policies will swell an already bloated budget deficit and reignite an inflation spiral that the Federal Reserve was only just finally quelling in the wake of the pandemic.

A key outstanding question for markets is whether Republicans end up with the “trifecta,” meaning a situation where they gain control of the Senate, the House and the White House. Beyond that, it remains to be seen whether Trump would actually deliver his campaign-trail promises. With October’s record-high for the S&P 500 now in sight, sectors viewed by analysts as likely to benefit under Trump advanced. Fossil-fuel energy companies, banks, pharmaceutical providers, prison managers and smaller capitalization companies all rose in early trading. Those seen as struggling under a Trump administration, including renewable energy stocks, declined.

In currency markets, the dollar reached its strongest in a year before paring the move. While Trump has advocated for a weaker exchange rate, investors reckon his policies will fan inflation and slow the pace of the Fed’s interest-rate cuts, thereby boosting the greenback. The tariffs he’s hailed would also likely hurt foreign economies more than the US.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Premarket: U.S. futures rise as chip stocks rally after TSMC results; economic data in focusEuropean stocks gain, euro weak ahead of ECB, ‘Trump trade’ lifts U.S. dollar

Premarket: U.S. futures rise as chip stocks rally after TSMC results; economic data in focusEuropean stocks gain, euro weak ahead of ECB, ‘Trump trade’ lifts U.S. dollar

Read more »