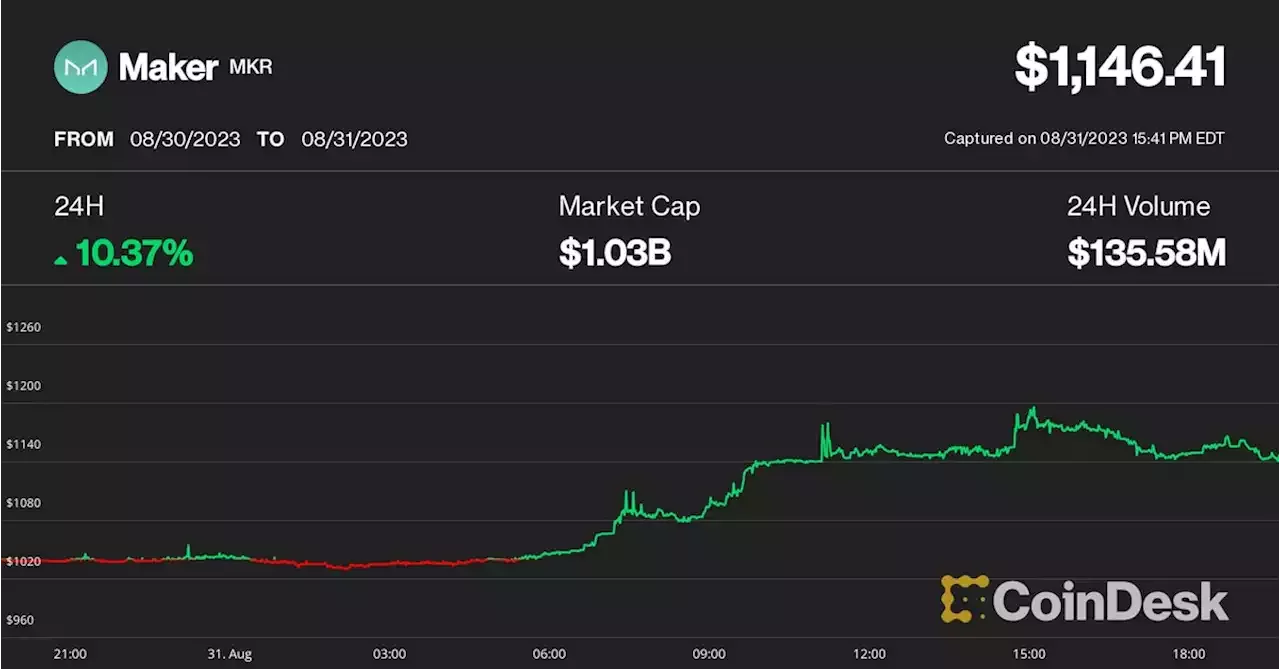

While there wasn’t any development to ignite the rally, MakerDAO’s fundamentals have improved recently, as the platform has returned to make profits after a brief increase in spending on incentives, Kunal Goel, senior research analyst at Messari, explained in an interview.is one of the largest crypto lending protocols and issuer of the $5 billion stablecoin DAI. The platform has increased revenues through investing its vast stablecoin reserves in real-world assets such as U.S.

Maker’s profit expectations, as CoinDesk reported. The platform lowered rewards and hiked borrowing rates, so it has been profitable again, Goel said.introduced last month, which reduces outstanding supply on the market using surplus revenues of the platform’s treasury.