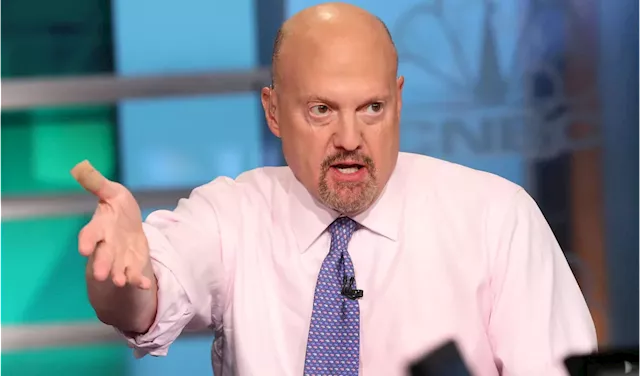

CNBC's Jim Cramer reviewed Tuesday's market-wide decline, attributing much of the pullback to some investors' worries about inflation in the run-up to new employment data.

"We have too much inflation in the system. The Fed can't do anything about it because it just cut rates. The Fed's in a bind. It can't help us," he said."So we're at the mercy of macro numbers that are going in the wrong direction…That's not a good place to be."attributed much of the pullback to investors' worries about inflation in the run-up to new employment data as well as a lack of faith in the Federal Reserve's decision-making.

"We have too much inflation in the system. The Fed can't do anything about it because it just cut rates. The Fed's in a bind. It can't help us," he said."So we're at the mercy of macro numbers that are going in the wrong direction…That's not a good place to be."by close, with the tech sector hit especially hard. Tuesday also saw two economic surveys come in higher than expected, suggesting inflation remains persistent, and long-termrose.

However, he cautioned against buying heavily into this weakness with labor data coming so soon. If employment and wages rise, or President-elect Donald Trump says mass deportations are on the horizon — which could cause mass wage inflation — the market will get crushed, especially tech stocks, Cramer continued. He called nonfarm payrolls"authoritative," saying they"control the dialogue.

"I don't want to make too much out of one session. That's too day trader-ish. But the setup, a big employment number coupled with earnings next week, does not favor the bulls," Cramer said."We need some signal, some sign, that the Fed did the right thing when it cut rates, or else we'll have more days like today when long rates go up and a lot of stocks go down.

Canada Canada Latest News, Canada Canada Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Cramer Blames Inflation Fears for Market DipCNBC's Jim Cramer attributes Tuesday's market decline to investor worries about inflation ahead of new employment data. He criticizes the Federal Reserve's handling of the situation and warns of the market's vulnerability to economic indicators.

Cramer Blames Inflation Fears for Market DipCNBC's Jim Cramer attributes Tuesday's market decline to investor worries about inflation ahead of new employment data. He criticizes the Federal Reserve's handling of the situation and warns of the market's vulnerability to economic indicators.

Source: nbcsandiego - 🏆 524. / 51 Read more »

Cramer Blames Inflation Fears for Market PullbackCNBC's Jim Cramer attributes the market downturn to investor worries about inflation and a lack of confidence in the Federal Reserve's actions.

Cramer Blames Inflation Fears for Market PullbackCNBC's Jim Cramer attributes the market downturn to investor worries about inflation and a lack of confidence in the Federal Reserve's actions.

Source: nbcchicago - 🏆 545. / 51 Read more »

Jim Cramer Blames Faulty Predictions for Market DownturnCNBC's Jim Cramer attributes recent market declines to overly optimistic predictions from companies and even the Federal Reserve. He emphasizes the importance of conservative guidance and cautions against making predictions without sufficient visibility. Cramer criticizes the Fed's recent rate cut announcement, arguing for a more cautious approach and adherence to data-driven decision-making.

Jim Cramer Blames Faulty Predictions for Market DownturnCNBC's Jim Cramer attributes recent market declines to overly optimistic predictions from companies and even the Federal Reserve. He emphasizes the importance of conservative guidance and cautions against making predictions without sufficient visibility. Cramer criticizes the Fed's recent rate cut announcement, arguing for a more cautious approach and adherence to data-driven decision-making.

Source: nbcchicago - 🏆 545. / 51 Read more »

Jim Cramer Blames Faulty Predictions for Recent Market DownturnCNBC's Jim Cramer attributes the recent market decline to overly optimistic predictions from both companies and the Federal Reserve. He argues that companies should only make predictions if they are confident in their accuracy and advises against exceeding expectations. Cramer criticizes the Fed for suggesting two rate cuts next year instead of four, leading to disappointment among investors. He also cites Micron's downbeat earnings call, where the company revised its PC business outlook, as an example of how unmet expectations can impact stock prices.

Jim Cramer Blames Faulty Predictions for Recent Market DownturnCNBC's Jim Cramer attributes the recent market decline to overly optimistic predictions from both companies and the Federal Reserve. He argues that companies should only make predictions if they are confident in their accuracy and advises against exceeding expectations. Cramer criticizes the Fed for suggesting two rate cuts next year instead of four, leading to disappointment among investors. He also cites Micron's downbeat earnings call, where the company revised its PC business outlook, as an example of how unmet expectations can impact stock prices.

Source: nbcsandiego - 🏆 524. / 51 Read more »

Cramer Blames Faulty Predictions for Market DownturnCNBC's Jim Cramer criticizes companies and the Federal Reserve for making overly aggressive predictions that failed to materialize, leading to investor disappointment and market sell-offs.

Cramer Blames Faulty Predictions for Market DownturnCNBC's Jim Cramer criticizes companies and the Federal Reserve for making overly aggressive predictions that failed to materialize, leading to investor disappointment and market sell-offs.

Source: NBCPhiladelphia - 🏆 569. / 51 Read more »

Cramer Blames Faulty Predictions for Recent Market DownturnCNBC's Jim Cramer attributes the recent market sell-off to overly aggressive and inaccurate predictions from companies and even the Federal Reserve. He emphasizes the importance of conservative guidance and staying mum when visibility for accurate predictions is lacking. Cramer cites the Fed's recent rate cut announcement and Micron's earnings call as examples of how unmet expectations can negatively impact stock performance.

Cramer Blames Faulty Predictions for Recent Market DownturnCNBC's Jim Cramer attributes the recent market sell-off to overly aggressive and inaccurate predictions from companies and even the Federal Reserve. He emphasizes the importance of conservative guidance and staying mum when visibility for accurate predictions is lacking. Cramer cites the Fed's recent rate cut announcement and Micron's earnings call as examples of how unmet expectations can negatively impact stock performance.

Source: NBCLA - 🏆 319. / 59 Read more »