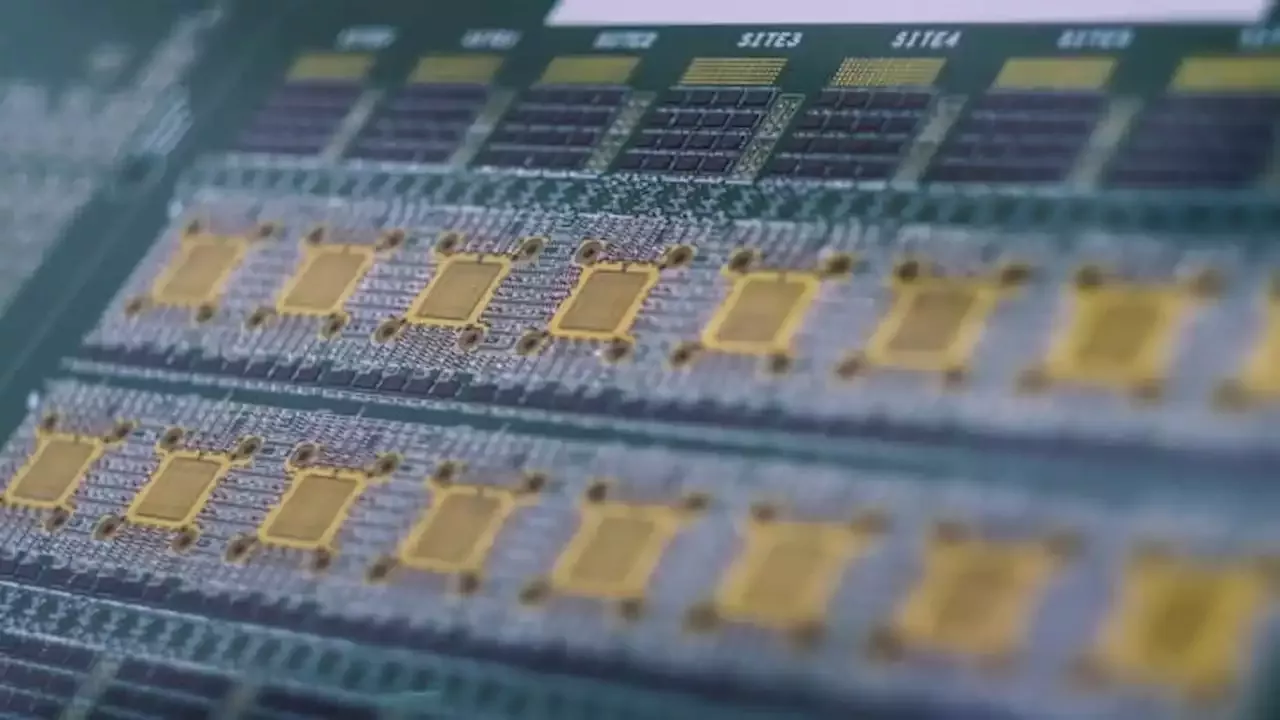

Analyst Brad Lin lifted his price target on U.S-listed shares of Taiwan Semiconductor Manufacturing to $125, representing 35% upside from Thursday's close. He cited "sustainable and strong" demand for AI products, which should meaningfully benefit the leading AI chipmaker and maker of edge nodes and advanced packaging.

" So far this year, shares of Taiwan Semiconductor have jumped about 23%, while Nvidia shares have more than doubled. Lin views Taiwan Semiconductor's valuation as attractive at nearly 14 times price-to-earnings, and near the lower end of its historical range.

Switzerland Neuesten Nachrichten, Switzerland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Bank of America Corp. stock rises Wednesday, still underperforms marketShares of Bank of America Corp. inched 0.04% higher to $28.45 Wednesday, on what proved to be an all-around great trading session for the stock market, with...

Bank of America Corp. stock rises Wednesday, still underperforms marketShares of Bank of America Corp. inched 0.04% higher to $28.45 Wednesday, on what proved to be an all-around great trading session for the stock market, with...

Weiterlesen »

Bank of America downgrades Peloton, slashes price target in half after earnings sell-offThe firm moved to the sidelines on the stock and halved its price target.

Bank of America downgrades Peloton, slashes price target in half after earnings sell-offThe firm moved to the sidelines on the stock and halved its price target.

Weiterlesen »