Canadian borrowers are dealing with a five-year fixed rate of around 4.5 to 5.5 per cent.are in the 3.8 to 4.5 per cent range. And rates are at least two per cent higher than a year ago.

“I don’t know how often you can buy something and then turn around and make a substantial profit in a short period of time. At minimum, mom and pop investors pay their mortgage down and typically the value of the asset will go up.” “The faster an investment moves, the closer you need to monitor it, especially with the recent hype of NFTs and cryptocurrency,” says Chan. “But look at any real estate market in the world with a growing population, and it was definitely cheaper 50 years ago than it is today.”

If the property increases by five per cent in a year on the $1 million investment, that’s an increase of $50,000, so the owner has a net positive of $25,000.When things are getting tight He gets his clients to write down all their property expenses, including management and maintenance fees, taxes, utilities, and any upcoming repairs on the home. If it’s a primary property that’s causing them stress, then he asks them to write out a cash flow budget spreadsheet to see what’s coming in and going out. McFadyen finds that the main culprit for expenses is often a car loan or credit card debt, or — more commonly these days — travel debt.

Colombia Últimas Noticias, Colombia Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

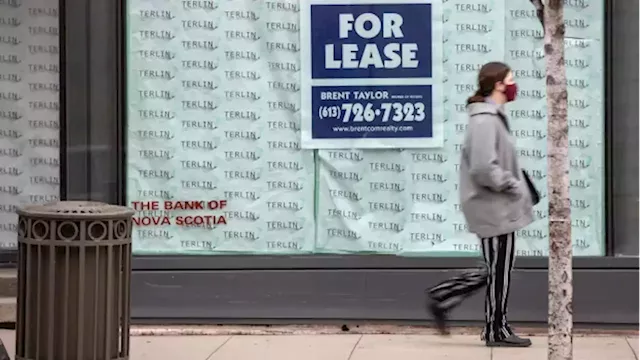

Commercial bankruptcies rising in Canada, says business lobby group | CBC NewsThe Canadian Federation of Independent Business says more than one in six Canadian small business owners say they are currently considering going out of business. We are closing April 2023 So happy you're talking to the little people, like a lobbying group that helps businesses fight unionization It's probably one in six at anytime. But I stand to be corrected.

Commercial bankruptcies rising in Canada, says business lobby group | CBC NewsThe Canadian Federation of Independent Business says more than one in six Canadian small business owners say they are currently considering going out of business. We are closing April 2023 So happy you're talking to the little people, like a lobbying group that helps businesses fight unionization It's probably one in six at anytime. But I stand to be corrected.

Leer más »