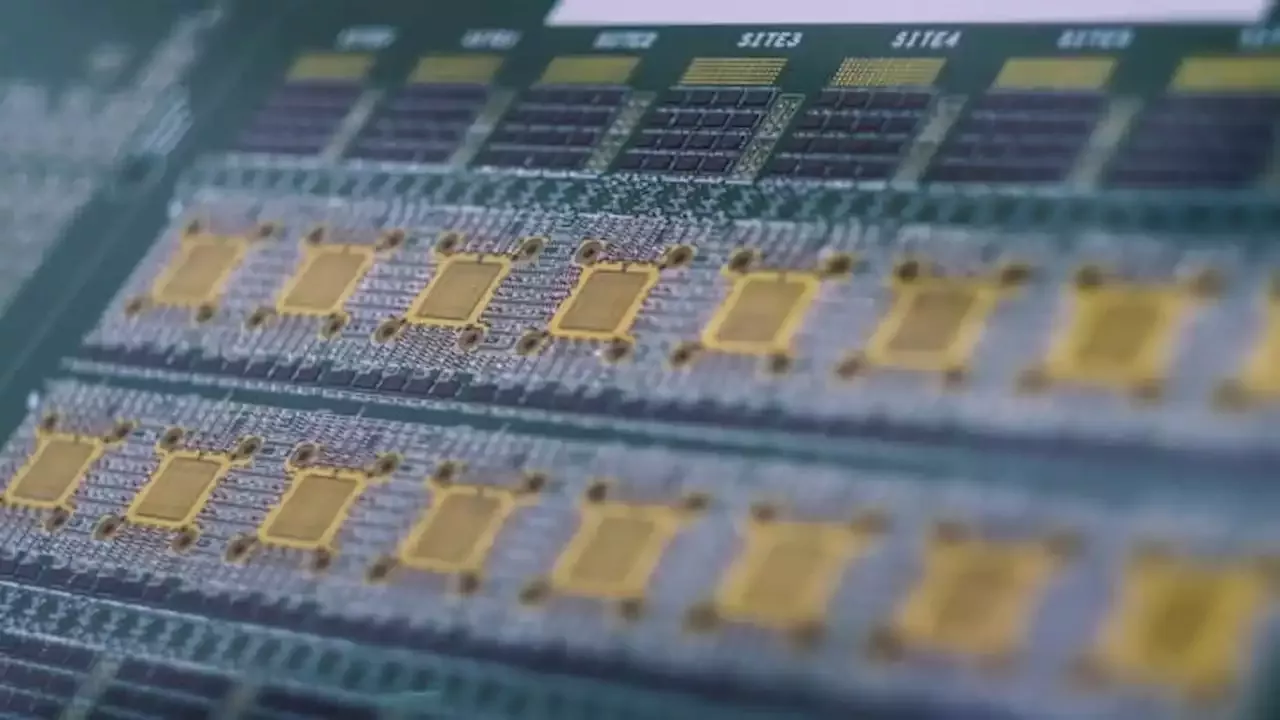

Analyst Brad Lin lifted his price target on U.S-listed shares of Taiwan Semiconductor Manufacturing to $125, representing 35% upside from Thursday's close. He cited "sustainable and strong" demand for AI products, which should meaningfully benefit the leading AI chipmaker and maker of edge nodes and advanced packaging.

" So far this year, shares of Taiwan Semiconductor have jumped about 23%, while Nvidia shares have more than doubled. Lin views Taiwan Semiconductor's valuation as attractive at nearly 14 times price-to-earnings, and near the lower end of its historical range.

Colombia Últimas Noticias, Colombia Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Bank of America Corp. stock rises Wednesday, still underperforms marketShares of Bank of America Corp. inched 0.04% higher to $28.45 Wednesday, on what proved to be an all-around great trading session for the stock market, with...

Bank of America Corp. stock rises Wednesday, still underperforms marketShares of Bank of America Corp. inched 0.04% higher to $28.45 Wednesday, on what proved to be an all-around great trading session for the stock market, with...

Leer más »

Bank of America downgrades Peloton, slashes price target in half after earnings sell-offThe firm moved to the sidelines on the stock and halved its price target.

Bank of America downgrades Peloton, slashes price target in half after earnings sell-offThe firm moved to the sidelines on the stock and halved its price target.

Leer más »