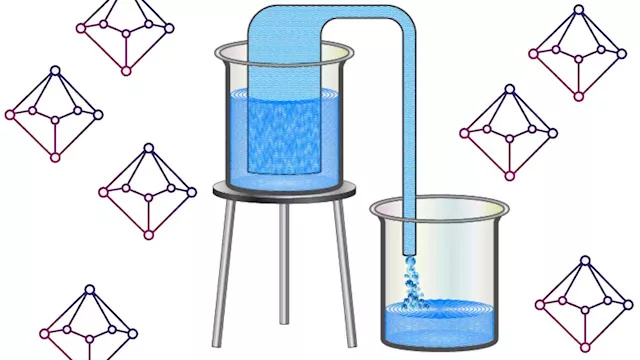

For the uninitiated, “re-entrancy” is a vulnerability in the Solidity programming language that enables a malicious entity to deceive a protocol’s smart contract into making an external call to an untrusted contract. After the attacker gains control of the untrusted contract, they can make recursive calls to the original function to drain its funds.

The re-entrancy attacks become more staggering since “the code executes interactions before applying the effects.” On the other hand, Aave tries to follow the aforementioned checks-effects-interactions pattern. However, there exists a path via liquidations using which the attacker “broke the pattern” in the recent attack. He went on to add,

“The agave and hundred protocol teams messed up by listing a token that can reenter. Aave and compound governance actively check for reentrancy before listing tokens on the mainnet to avoid similar attacks.” Popular DeFi lending platform Cream Finance, which shares a similar codebase to that of Compound, was alsoAccording to a developer at DeFi protocol DanceFloor, “Shegan,” the funds are not safe. However, Martin Köppelmann, the founder of Gnosis,

he would support a measure from the DAO. The team behind Hundred Finance and Agave is currently investigating the exploits and has paused the contracts.

Don't get rekt 💎Protect your favorite tokens against hacks and protocol failures. ✅Best price on the market ✅Widest range of covers available ✅Coverage starting 1.8% annually Check covers: Coveryourcapital

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

DeFi protocols Agave and Hundred Finance exploited on Gnosis Chain for $11 millionTwo DeFi protocols on the Gnosis Chain have suffered a flash loan-assisted reentrancy attack with $11 million stolen.

DeFi protocols Agave and Hundred Finance exploited on Gnosis Chain for $11 millionTwo DeFi protocols on the Gnosis Chain have suffered a flash loan-assisted reentrancy attack with $11 million stolen.

Weiterlesen »

‘Unlucky’: Agave and Hundred Finance DeFi protocols exploited for $11M“It’s like you can't even trust 'safe' code,” said developer Shegen, who lost $225K in the exploit of Agave and Hundred Finance. In total, the attacker made off with around $11M. We don't buy bitcoin We earn bitcoin From Mining I'm ready to show 10 lucky people how to earn 0.1BTC ($4,000) and more daily! No referral No withdrawal fees If interested, kindly send a DM

‘Unlucky’: Agave and Hundred Finance DeFi protocols exploited for $11M“It’s like you can't even trust 'safe' code,” said developer Shegen, who lost $225K in the exploit of Agave and Hundred Finance. In total, the attacker made off with around $11M. We don't buy bitcoin We earn bitcoin From Mining I'm ready to show 10 lucky people how to earn 0.1BTC ($4,000) and more daily! No referral No withdrawal fees If interested, kindly send a DM

Weiterlesen »

More Than 80% of the Funds Locked in Decentralized Finance Are Kept on 5 Chains, 21 Different Defi Protocols – Defi Bitcoin NewsThe top five blockchains in defi currently command more than 82% of the $198 billion TVL in defi across all blockchains. EverCash, a BUSD rewards based + hyperdeflationary token launched days ago Ecash Utility💎 Ecash wallet Ecash tracker rewards Peer to Peer Market UNIQUE TOKENOMIC FEATURES 💎 🟢 2% BUSD Rewards 🔥 2% Buy Back & Burn ♻️ 1% LP 💰 1% Marketing bankrupt blinmetaverse blin blin fake Ever heard of $POND by MarlinProtocol It's one of my favourite project and I'm sure it'll X100 this month.

More Than 80% of the Funds Locked in Decentralized Finance Are Kept on 5 Chains, 21 Different Defi Protocols – Defi Bitcoin NewsThe top five blockchains in defi currently command more than 82% of the $198 billion TVL in defi across all blockchains. EverCash, a BUSD rewards based + hyperdeflationary token launched days ago Ecash Utility💎 Ecash wallet Ecash tracker rewards Peer to Peer Market UNIQUE TOKENOMIC FEATURES 💎 🟢 2% BUSD Rewards 🔥 2% Buy Back & Burn ♻️ 1% LP 💰 1% Marketing bankrupt blinmetaverse blin blin fake Ever heard of $POND by MarlinProtocol It's one of my favourite project and I'm sure it'll X100 this month.

Weiterlesen »

Hacker Siphons $3 Million Worth of DAI and ETH From Defi Protocol Deus Finance – Bitcoin NewsAccording to a post mortem report, DeusFinance lost around $3 million worth of ethereum and the stablecoin DAI. Another day, another DeFi hack. This is what happens when you race to release your MVP. You can't do that in finance. Trading has been alot easier for me since I came in contact with Mrs layahheil pern....I made $6000 in just 7 days of trading with $500 start up.....👇👇👇 Mrs layahheil pern strategies work's like magic....I Made $5000 in just 7 days of my investment with little start up capital of $500.. you can reach her on WhatsApp..👇👇👇

Hacker Siphons $3 Million Worth of DAI and ETH From Defi Protocol Deus Finance – Bitcoin NewsAccording to a post mortem report, DeusFinance lost around $3 million worth of ethereum and the stablecoin DAI. Another day, another DeFi hack. This is what happens when you race to release your MVP. You can't do that in finance. Trading has been alot easier for me since I came in contact with Mrs layahheil pern....I made $6000 in just 7 days of trading with $500 start up.....👇👇👇 Mrs layahheil pern strategies work's like magic....I Made $5000 in just 7 days of my investment with little start up capital of $500.. you can reach her on WhatsApp..👇👇👇

Weiterlesen »