A bear market - often thought of as a 20% or more decline from a high - would mark the end of the pandemic-era rally that sent stocks to record levels on the back of unprecedented stimulus from the Federal Reserve.

Bearish sentiment in a weekly poll taken by the American Association of Individual Investors stood at 52.9% the week that ended May 4, well above the average rating of 30.5%, while BofA’s survey of fund managers last month showed optimism regarding global growth at an all-time low. The Federal Reserve announced a 50 basis point hike last week and signaled that it will raise rates by 50 basis points at its next two meetings. Investors are currently pricing in a total of 209 basis points in tightening this year, putting the central bank on track for its most aggressive tightening path since 1994.

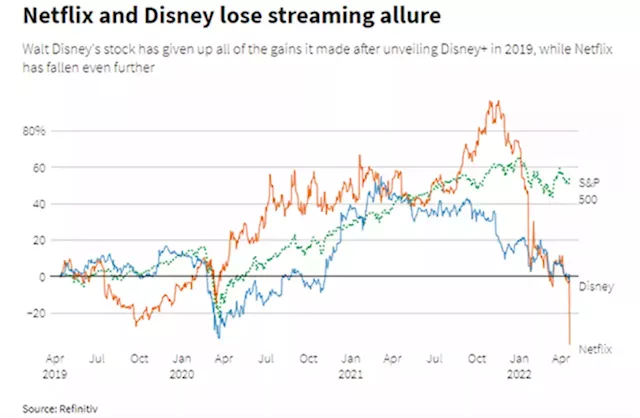

"It’s conceivable the S&P 500 needs to establish a bottom" that would take it into a bear market, given that the index hit 70 new records last year without more than a 5% pullback, he wrote Friday. Analysts at Truist Advisory Services downgraded their market targets last month but have not grown more negative in the most recent decline, wrote Keith Lerner, the firm's co-chief investment officer.

if it crashes, what happens to gas prices?

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

El Salvador Acquires 500 Additional Bitcoin Amid Market DropEl Salvador has “bought the dip,” acquiring 500 bitcoin for an average price of $30,744 each, President NayibBukele tweeted on Monday. andresengler reports nayibbukele andresengler Not Enough... We need 100x that nayibbukele andresengler $2 per citizen.. ElScamador fooled you nayibbukele andresengler 👊🏻🇸🇻🌋

El Salvador Acquires 500 Additional Bitcoin Amid Market DropEl Salvador has “bought the dip,” acquiring 500 bitcoin for an average price of $30,744 each, President NayibBukele tweeted on Monday. andresengler reports nayibbukele andresengler Not Enough... We need 100x that nayibbukele andresengler $2 per citizen.. ElScamador fooled you nayibbukele andresengler 👊🏻🇸🇻🌋

Weiterlesen »

S&P 500 Outlook: Equities Drop Ahead of Peloton, Disney and Alibaba EarningsAsian Indices traded lower with the Hang Seng trading lower by 3.8% while the Shanghai Composite ended the day fairly unchanged. Get your market update from RichardSnowFX here:

S&P 500 Outlook: Equities Drop Ahead of Peloton, Disney and Alibaba EarningsAsian Indices traded lower with the Hang Seng trading lower by 3.8% while the Shanghai Composite ended the day fairly unchanged. Get your market update from RichardSnowFX here:

Weiterlesen »