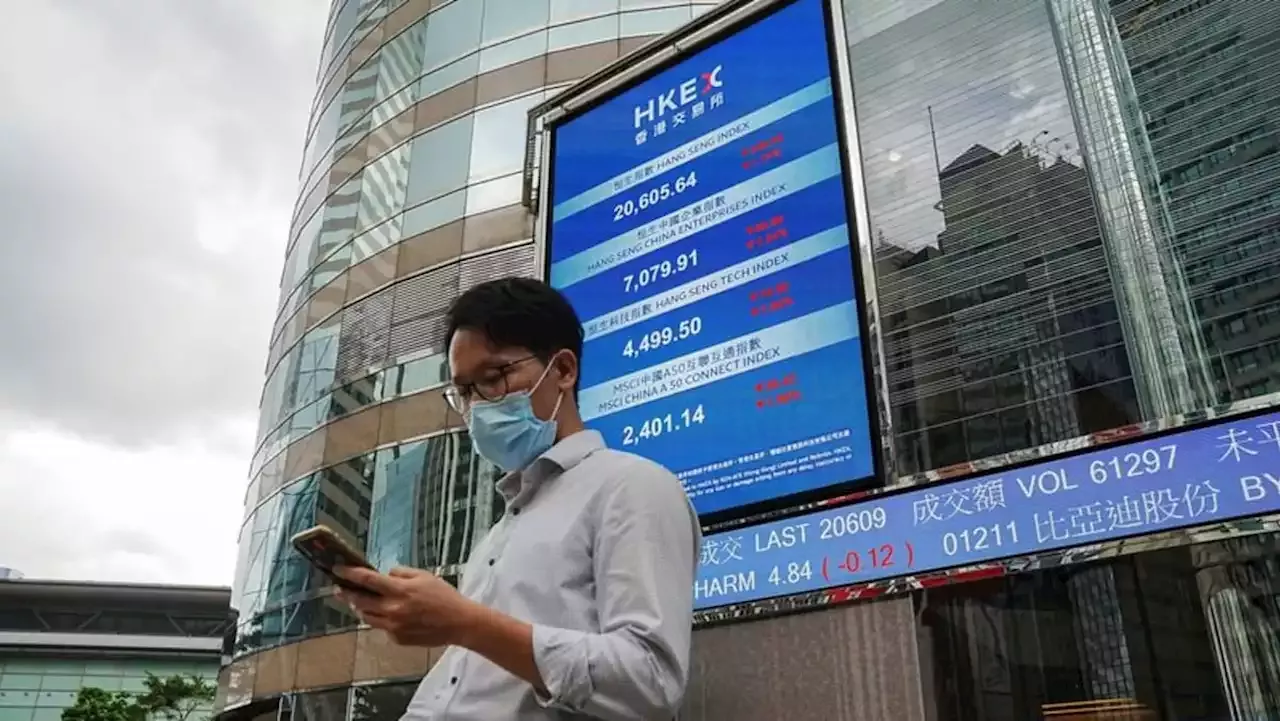

HONG KONG: Hong Kong is set to see billions of dollars flowing in from the mainland with more Chinese companies expected to upgrade their listings in the city to tap into a bigger pool of capital amid the looming threat of delistings in the United States.

The main advantage for the companies upgrading their listings in Hong Kong to dual primary is that they can apply to be included in Stock Connect, a link to the city's bourse which allows mainland Chinese investors to buy stocks more easily. "It could be a good example when you have the giant converting from a secondary listing to a dual primary for others to follow suit," said Stephanie Tang, a partner at law firm Hogan Lovells.

Goldman Sachs said in a report southbound buying could reach almost US$30 billion if Alibaba and 14 other secondary listed companies in Hong Kong converted to a dual primary listing. Increased numbers of dual primary listings is unlikely to deliver capital markets investment bankers a windfall, though, with most of the prospective candidates not needing to issue new shares.