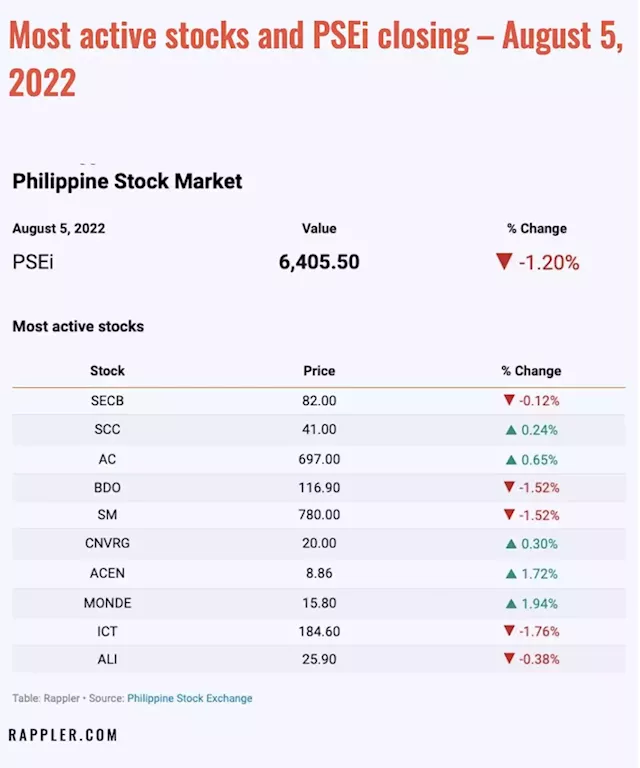

“Last week, the local market was able to get past its 6,400 resistance level. This coming trading week, the market could move on a cautious tone as investors continue to digest the corporate earnings reports while at the same time, deal with monetary policy concerns,” said Philstocks Financial Senior Supervisor for Research Japhet Tantiangco.He added that, Investors are also expected to watch out for our second quarter GDP data and June labor data for clues on the health of our economy.

Stock brokerage 2TradeAsia.com said the 3-year high July inflation figure comes amid “drivers that have been volatile as of late” with although global commodity prices have been declining. It explained that, “This is a roundabout way of saying that, at the consumer level, medium-term inflation outlook remains elevated, even concerning , but at a long-term lens, supply drivers are looking to be more favorable for corporates and considering demand impact from global rate hikes has yet to be fully priced-in until 2023.”

It noted that, for the first half of 2022, Semirara’s “earnings beat estimates due to the coal business’ better than expected earnings.” COL is also recommending SM Investments because “We are raising our full year 2022 income forecast for SM from P43.8 billion to P47.5 billion following the better-than-expected first half 2022 earnings from SM Retail.”

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Philippine stocks: Gainers, losers, market-moving news – August 2022Bookmark and refresh this page for the latest news and analysis on stock market movers, corporate and financial news, business deals, and the economy in the Philippines

Philippine stocks: Gainers, losers, market-moving news – August 2022Bookmark and refresh this page for the latest news and analysis on stock market movers, corporate and financial news, business deals, and the economy in the Philippines

Weiterlesen »