Shares of the EV industry leader have been in freefall over the past few months, sinking nearly 40% since the end of September, compared with a 12% advance in the S&P 500.

Concerns about EV demand, as well as chief executive officer Elon Musk’s preoccupation with the overhaul of Twitter Inc, have both weighed heavily on the stock this year.A block of 3.11 million shares traded at a market value of US$500mil . A seemingly insatiable investor appetite for anything related to EVs, and more broadly, technology, helped fuel part of that rally in a cash-rich market.

Tesla is the first EV technology mover. Now that the hype is over .... EV market will be lead by real car manufacturers- the likes of German, Japanese,Korean and Chinese EV vehicles

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

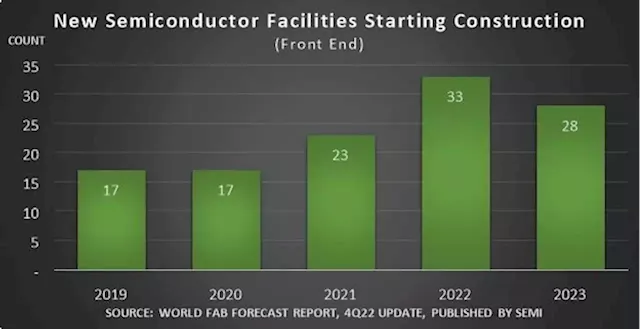

Global chip industry projected to invest more than US$500bil in new factories by 2024PETALING JAYA: The worldwide semiconductor industry is projected to invest more than US$500bil in 84 volume chipmaking facilities starting construction from 2021 to 2023, SEMI announced in its latest quarterly World Fab Forecast report.

Global chip industry projected to invest more than US$500bil in new factories by 2024PETALING JAYA: The worldwide semiconductor industry is projected to invest more than US$500bil in 84 volume chipmaking facilities starting construction from 2021 to 2023, SEMI announced in its latest quarterly World Fab Forecast report.

Herkunft: staronline - 🏆 4. / 75 Weiterlesen »