A slate of economic events and data are on deck for next week. In the spotlight are the Federal Reserve’s May meeting and the April jobs report. What’s expected from the Fed? Analysts expect the central bank to raise rates by a quarter point on Wednesday, and will look for guidance about the Fed’s plans for the rest of the year. Inflation data has been mixed in recent days. The Personal Consumption Expenditures price index, the Fed’s favorite inflation gauge, rose 4.

releases its review of Signature Bank failure Signature Bank failed due to “poor management,” the Federal Deposit Insurance Corporation said in a widely anticipated report released Friday. The government agency said that contagion effects from Silicon Valley Bank’s collapse and crypto-friendly lender Silvergate Bank’s self-liquidation was not the cause for Signature Bank’s failure, though it did help fuel a run on deposits.

, said on a call with reporters Friday. “Even though they were crypto cash deposits, it was a traditional kind of bank run.” The also admitted that it didn’t provide Signature Bank with adequate and timely reviews prior to the bank failures, citing staffing shortages between 2017 and 2023 at the government agency. Read more here. Up next Monday: April ISM manufacturing Tuesday: March JOLTS report. Earnings reports from Pfizer , Advanced Micro Devices , Starbucks , Uber and Ford . Wednesday: Federal Reserve interest rate decision, Chairman Jerome Powell’s press conference and April ADP private payroll report.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

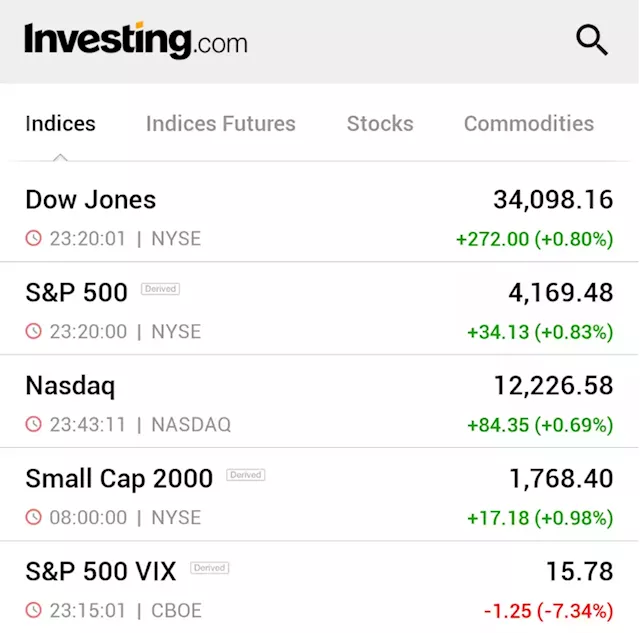

Wall St climbs as strong earnings offset slowdown worries, Fed meeting in focusU.S. stock indexes advanced on Friday after strong earnings updates from Exxon and Intel offset worries over Amazon's slowdown warning, while economic data reinforced expectations that the Federal Reserve would hike interest rates next week.

Wall St climbs as strong earnings offset slowdown worries, Fed meeting in focusU.S. stock indexes advanced on Friday after strong earnings updates from Exxon and Intel offset worries over Amazon's slowdown warning, while economic data reinforced expectations that the Federal Reserve would hike interest rates next week.

Weiterlesen »

Wall St climbs as strong earnings offset slowdown worries, Fed meeting in focus By Reuters⚠️BREAKING: *U.S. STOCKS RALLY ON FRIDAY TO CAP WINNING WEEK AS AMAZON SINKS AND FIRST REPUBLIC COLLAPSES $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Wall St climbs as strong earnings offset slowdown worries, Fed meeting in focus By Reuters⚠️BREAKING: *U.S. STOCKS RALLY ON FRIDAY TO CAP WINNING WEEK AS AMAZON SINKS AND FIRST REPUBLIC COLLAPSES $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Weiterlesen »

Wall St ends higher, posts weekly, monthly gains on solid earnings, Fed pause hopes By Reuters*WALL ST ENDS HIGHER, POSTS WEEKLY, MONTHLY GAINS ON SOLID EARNINGS, FED PAUSE HOPES $DIA $SPY $QQQ 🇺🇸🇺🇸

Wall St ends higher, posts weekly, monthly gains on solid earnings, Fed pause hopes By Reuters*WALL ST ENDS HIGHER, POSTS WEEKLY, MONTHLY GAINS ON SOLID EARNINGS, FED PAUSE HOPES $DIA $SPY $QQQ 🇺🇸🇺🇸

Weiterlesen »

Stock Market Today: Wall Street Rises to Cap a Winning AprilWall Street closed out a winning April with gains Friday as more companies say their profits at the start of the year weren’t as bad as expected.

Stock Market Today: Wall Street Rises to Cap a Winning AprilWall Street closed out a winning April with gains Friday as more companies say their profits at the start of the year weren’t as bad as expected.

Weiterlesen »