West Texas Intermediate climbed for a seventh day, extending the longest such run since January and bringing prices to the highest since November. U.S. futures have advanced about 6 per cent this week, heading for the biggest weekly gain since April.

“$85 WTI is a huge psychological level,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth. “To break through and hold we will need confirmation of Saudi-Russia cut extensions and confidence that China stimulus has started to take hold and improve sentiment there. I think we will break above $85 and hold, but we may test and fail a few times first.”

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

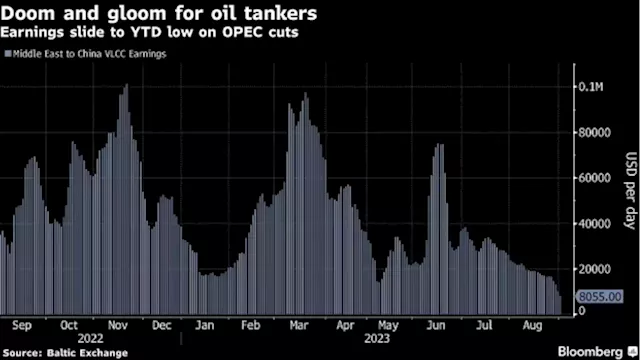

Oil Tanker Earnings Plummet Amid Outlook for Deeper OPEC+ CurbsEarnings for oil tankers in the Middle East declined to the lowest level so far this year as the prospect of deeper OPEC+ production curbs darkened the outlook for the sector.

Oil Tanker Earnings Plummet Amid Outlook for Deeper OPEC+ CurbsEarnings for oil tankers in the Middle East declined to the lowest level so far this year as the prospect of deeper OPEC+ production curbs darkened the outlook for the sector.

Weiterlesen »

Oil dips as China factory activity shrinks; market eyes U.S. dataBrent crude futures for October, which expire on Thursday, dipped 9 cents, or 0.1%, at $85.77 per barrel by 0630 GMT. The more active November contract was down 10 cents, or 0.1%, at $85.14

Oil dips as China factory activity shrinks; market eyes U.S. dataBrent crude futures for October, which expire on Thursday, dipped 9 cents, or 0.1%, at $85.77 per barrel by 0630 GMT. The more active November contract was down 10 cents, or 0.1%, at $85.14

Weiterlesen »