- Something odd just happened in U.S. short-term funding markets: a benchmark interest rate suddenly fell precipitously on March 19 before bouncing back up the next day.

Behind the drop was a large, single trade late in the day involving a big player, according to three market sources and a review of publicly available transaction data. The trade was in the mid-$20 billion range at a 5% rate and happened sometime after 1 pm, according to two of the sources. The aberrant trade poses a mystery that's worth solving for the sake of transparency in one of the world's most important markets. While the incident may be contained, with the market working as intended, information about what went on could provide important insights into market function.

Duffie, however, noted that there was no obvious sign that it represented"an undue risk to the financial system or bad behavior." If the trade involved a government sponsored enterprise or money market fund, it could provide information about the institution's risk controls. The impact of the March 19 trade on the overall market was limited. Other benchmark rates based off transactions in the market, such as the Secured Overnight Financing Rate and the Broad General Collateral Rate, were not affected by the trade.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

TON Defies Market Sentiment With a Massive 23% Surge, BTC Slumps Toward $70K (Market Watch)Crypto Blog

TON Defies Market Sentiment With a Massive 23% Surge, BTC Slumps Toward $70K (Market Watch)Crypto Blog

Weiterlesen »

Stock market today: Asia stocks rise with market focus on signs of interest rate cutAsia stocks are mostly higher, with investors mainly focusing on a U.S. inflation report and what it means for interest rate cuts by the Federal Reserve. Oil prices advanced while U.S. futures were mixed. The yen weakened, coming close to a 34-year low.

Stock market today: Asia stocks rise with market focus on signs of interest rate cutAsia stocks are mostly higher, with investors mainly focusing on a U.S. inflation report and what it means for interest rate cuts by the Federal Reserve. Oil prices advanced while U.S. futures were mixed. The yen weakened, coming close to a 34-year low.

Weiterlesen »

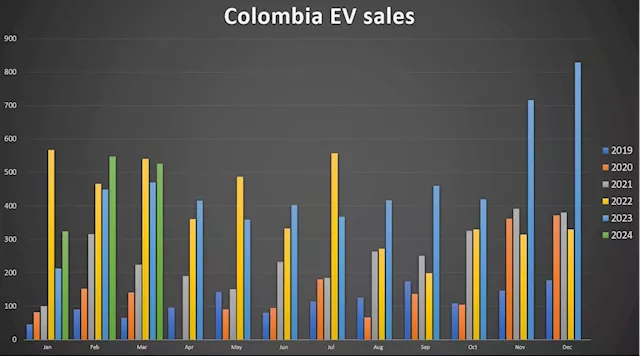

Colombia’s EV Market Grew 23% in Q1 & Reached 4% Market Share in MarchQ1 report: EV sales grow 23% in Colombia amidst a falling market, reach 4% Market Share in March!

Colombia’s EV Market Grew 23% in Q1 & Reached 4% Market Share in MarchQ1 report: EV sales grow 23% in Colombia amidst a falling market, reach 4% Market Share in March!

Weiterlesen »

Stock market today: Hong Kong stocks lead Asia market gains while developer Vanke slumpsHong Kong stocks are leading gains in Asian markets while investors evaluate economic data from South Korea and Australia.

Stock market today: Hong Kong stocks lead Asia market gains while developer Vanke slumpsHong Kong stocks are leading gains in Asian markets while investors evaluate economic data from South Korea and Australia.

Weiterlesen »

Stock market today: Hong Kong stocks lead Asia market gains while developer Vanke slumpsHong Kong stocks are leading gains in Asian markets while investors evaluate economic data from South Korea and Australia.

Stock market today: Hong Kong stocks lead Asia market gains while developer Vanke slumpsHong Kong stocks are leading gains in Asian markets while investors evaluate economic data from South Korea and Australia.

Weiterlesen »

Stock market today: Hong Kong stocks lead Asia market gains while developer Vanke slumpsHong Kong stocks are leading gains in Asian markets while investors evaluate economic data from South Korea and Australia. U.S. futures were lower while oil prices rose. China real estate developer Vanke’s Hong Kong-listed shares slumped 11.4% on Tuesday after the company reported last week of a notable decrease in profit and no dividend payout.

Stock market today: Hong Kong stocks lead Asia market gains while developer Vanke slumpsHong Kong stocks are leading gains in Asian markets while investors evaluate economic data from South Korea and Australia. U.S. futures were lower while oil prices rose. China real estate developer Vanke’s Hong Kong-listed shares slumped 11.4% on Tuesday after the company reported last week of a notable decrease in profit and no dividend payout.

Weiterlesen »