"Spaving" – spending more to save – is an old "trap" with a new name hitting grocery stores, retailers and even online gambling. Though there are times "spaving" is worthwhile, one personal finance expert outlined how consumers can avoid becoming the "victim" of the marketing ploy.

GEN Z LEAN ON CREDIT MORE THAN MILLENNIALS DID AND RACKING UP MORE DEBT Consumers must first remind themselves to "buy what you intend to buy," he stressed. "Don't buy what you feel pressured to buy. That's when you become almost like a victim of the marketing ploy. And that's obviously good for the retailer but not good for the consumer.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Beyond Banking Apps: How Embedded Finance Is Reshaping FinanceIvo Gueorguiev, co-founder at Paynetics. Read Ivo Gueorguiev's full executive profile here.

Beyond Banking Apps: How Embedded Finance Is Reshaping FinanceIvo Gueorguiev, co-founder at Paynetics. Read Ivo Gueorguiev's full executive profile here.

Weiterlesen »

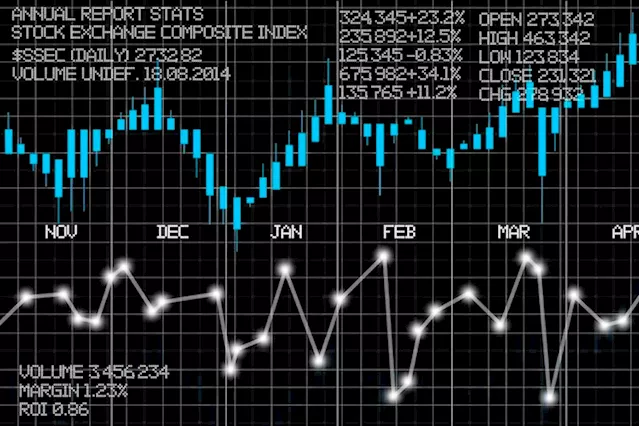

Behavioral FinanceBehavioral finance is the study of how psychology affects investor behavior and financial markets.

Behavioral FinanceBehavioral finance is the study of how psychology affects investor behavior and financial markets.

Weiterlesen »

Why FinTech is set to dominate the financial industry?The financial industry stands on the brink of a transformative era driven by Financial Technology (FinTech).

Why FinTech is set to dominate the financial industry?The financial industry stands on the brink of a transformative era driven by Financial Technology (FinTech).

Weiterlesen »