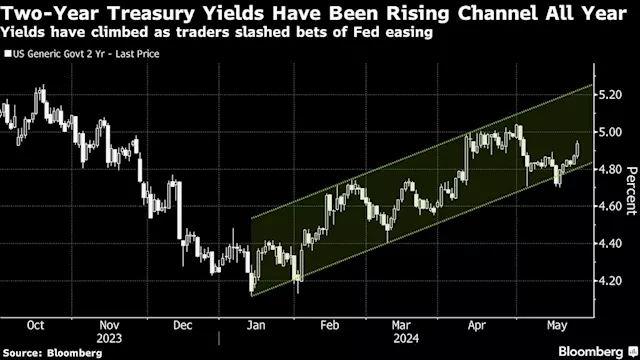

TOKYO - Asian equities rallied on Thursday, while bond yields slid, as investors weighed cooling U.S. inflation against a more hawkish posture by the Federal Reserve.

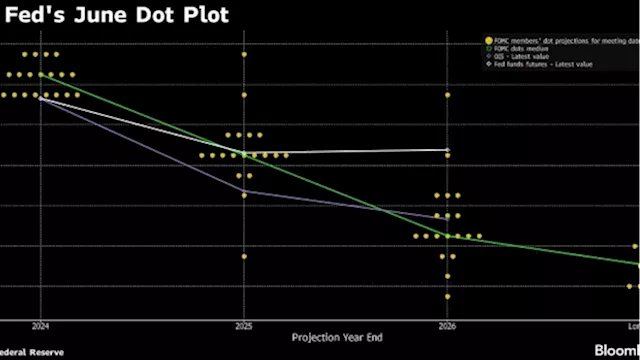

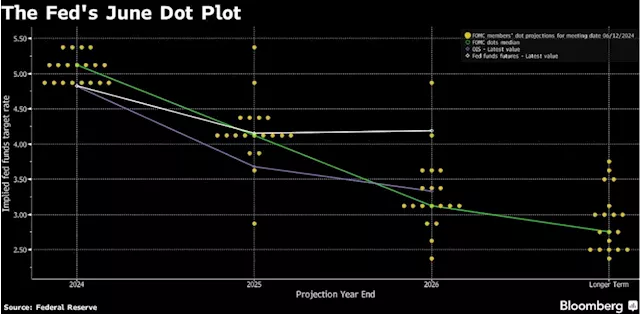

However, investors were whipsawed later as Fed officials trimmed projections for interest rate reductions this year to a single quarter-point cut. "These projections remain hostage to the incoming data, on that front, the May consumer price index was a genuine dovish surprise," said Nick Ferres, chief investment officer at Vantage Point, Singapore.

The Nikkei newspaper reported that the BOJ is likely to debate a reduction in monthly bond purchases at its policy gathering ending Friday, echoing earlier reports from Reuters and other news outlets. The yen was a notable underperformer against the dollar overnight, while most other major currencies registered substantial gains.Meanwhile, the euro held steady at $1.0808 after firming 0.64% overnight.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Asian Stocks Set to Slide as Fed Cuts Seen Delayed: Markets Wrap(Bloomberg) -- Asian stocks are poised to track Wall Street lower following activity data that signaled the Federal Reserve may keep rates on hold for most...

Asian Stocks Set to Slide as Fed Cuts Seen Delayed: Markets Wrap(Bloomberg) -- Asian stocks are poised to track Wall Street lower following activity data that signaled the Federal Reserve may keep rates on hold for most...

Weiterlesen »

Asia Stocks Poised to Follow US Higher Post-Fed: Markets WrapAsian stocks are set to track US peers higher as the Federal Reserve’s cautious outlook on interest rates did little to alter Wall Street’s bets on cuts.

Asia Stocks Poised to Follow US Higher Post-Fed: Markets WrapAsian stocks are set to track US peers higher as the Federal Reserve’s cautious outlook on interest rates did little to alter Wall Street’s bets on cuts.

Weiterlesen »

Asia Stocks Poised to Follow US Higher Post-Fed: Markets Wrap(Bloomberg) -- Asian stocks are set to track US peers higher as the Federal Reserve’s cautious outlook on interest rates did little to alter Wall Street’s...

Asia Stocks Poised to Follow US Higher Post-Fed: Markets Wrap(Bloomberg) -- Asian stocks are set to track US peers higher as the Federal Reserve’s cautious outlook on interest rates did little to alter Wall Street’s...

Weiterlesen »