The Markets in Crypto-Assets regulation — a comprehensive regulatory framework established by the European Union to regulate the cryptocurrency and digital asset market across member states — is approaching a key deadline on June 30.

While existing stablecoin issuers must begin aligning their operations with certain MiCA requirements from the June 30 deadline, the most stringent requirements, such as capital and reserve obligations, come into full effect later, ensuring a transitional period for existing businesses to adapt.

“Stablecoins are the first component of the digital assets sector to come under MiCA’s regulatory umbrella, due to their systemic importance and potential risk. As the world watches this crucial test of MiCA’s efficacy, the stakes are certainly high. But instead of the anticipated regulatory clarity, confusion and chaos seem to dominate the landscape,” he added.

However, Binance appeared to concede the looming regulation could present challenges. "Currently there are few regulated stablecoins with limited liquidity that may not be sufficient to support sudden demand across the industry," the exchange said in a blog post at the time. Last week, Tether CEO Paolo Ardoino told The Block that the EU’s MiCA regulation “contains several problematic requirements” that “could not only render the job of a stablecoin issuer extremely complex but also make EU-licensed stablecoins extremely vulnerable and riskier to operate.”

Ardoino said in the lead-up to the impending effective dates for stablecoin issuers and crypto asset service providers in the EU that "Tether has engaged extensively with its exchange counterparties in Europe regarding the requirements, including those pertaining to the ongoing listing of USDT and other Tether tokens, and the interpretation of key regulatory provisions."

“HTX has no further comment on MiCA regulations,” a spokesperson for the crypto exchange formerly known as Huobi told The Block.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

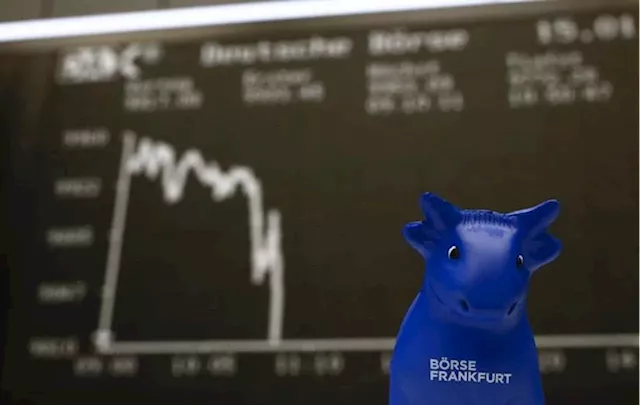

European stocks slump after European vote, shock French electionEuropean stocks slump after European vote, shock French election

European stocks slump after European vote, shock French electionEuropean stocks slump after European vote, shock French election

Weiterlesen »

European stocks lose steam after European Central Bank cutEuropean stocks moved lower on Friday, after closing at a record high during the previous session.

European stocks lose steam after European Central Bank cutEuropean stocks moved lower on Friday, after closing at a record high during the previous session.

Weiterlesen »

European stocks open marginally higher after European Central Bank cutEuropean stocks opened slightly higher on Friday, after closing at a record high during the previous session.

European stocks open marginally higher after European Central Bank cutEuropean stocks opened slightly higher on Friday, after closing at a record high during the previous session.

Weiterlesen »