A recalibration of how the U.S. presidential election plays out is causing bond investors to bet yields stay higher for longer as November approaches.

Republican National Committee spokesperson Anna Kelly said in a statement that the market reaction to Trump’s “debate victory reflected the anticipation of the strong-growth, low-inflation reality that President Trump will deliver once again.”“The lens really starting to turn to the fiscal and the debt dynamics,” said Mary-Therese Barton, fixed income chief investment officer at Pictet Asset Management. “ rate-cutting cycle is perhaps shallower than expected with a focus more on the longer end.

Shorter-dated Treasuries, more directly linked to changes in monetary policy, could still rally in case of rate cuts, but even for bond bulls the outlook for longer-dated Treasuries has become cloudier. Longer dated debt tends to reflect expectations for economic growth, inflation and the fiscal outlook.

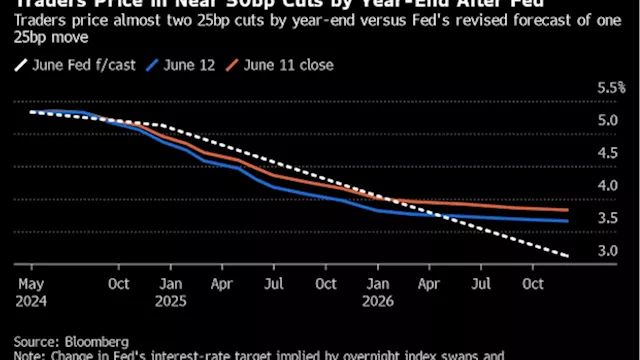

Investors had bet heavily early this year on a normalization of interest rates, but that has sharply changed with the Fed increasingly being seen as pushing rate cuts out further. Traders of futures contracts tied to the Fed’s policy rate are betting on about two rate cuts for the rest of 2024, one-third of the policy easing investors were hoping for in January.

A measure of total returns for Treasuries since the beginning of the year remains in negative territory despite yields having declined from their annual peak in April. “We still have six months left to carry in fixed income … and obviously if yields move lower from here still, there’s potential for even more appreciation,” said Mike Cudzil, managing director and generalist portfolio manager at PIMCO, one of the world’s biggest bond investors.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Bond Market Splits From Fed Again by Betting on 2024 Rate Cuts(Bloomberg) -- Bond traders loaded back up on interest-rate-cut bets — and even the pushback coming out of the Federal Reserve did little to shake their...

Bond Market Splits From Fed Again by Betting on 2024 Rate Cuts(Bloomberg) -- Bond traders loaded back up on interest-rate-cut bets — and even the pushback coming out of the Federal Reserve did little to shake their...

Weiterlesen »

Bond Market Splits From Fed Again by Betting on 2024 Rate CutsBond traders loaded back up on interest-rate-cut bets — and even the pushback coming out of the Federal Reserve did little to shake their conviction.

Bond Market Splits From Fed Again by Betting on 2024 Rate CutsBond traders loaded back up on interest-rate-cut bets — and even the pushback coming out of the Federal Reserve did little to shake their conviction.

Weiterlesen »

Analysis-Bond market re-focus on US elections throws wrench into 2024 rally hopesA recalibration of how the U.S. presidential election plays out is causing bond investors to bet yields stay higher for longer as November approaches...

Analysis-Bond market re-focus on US elections throws wrench into 2024 rally hopesA recalibration of how the U.S. presidential election plays out is causing bond investors to bet yields stay higher for longer as November approaches...

Weiterlesen »