Morgan Stanley says that Chinese stocks could enjoy a more "sustained rally" in the next phase — beyond a near-term jump — as they ride on the wave of stimulus measures and signals announced last week. "The policy pivot last week ... exceeded our expectations, with forceful monetary easing and unprecedented measures aimed at stabilizing and supporting the stock market and halting the property market's decline," Morgan Stanley analysts wrote in a Sept. 29 report.

Stock screens Morgan Stanley did a few stock screens to sieve out those set to benefit. Here are two of them. The first showed six stocks – listed in Hong Kong - that turned up, which trade at deep discounts to A-shares, and should benefit from the central bank's announcements, it said. The second one screened out these stocks which have a current dividend yield below 2.25%, but with free cash flow yield "meaningfully" above 4% — versus the 2.25% borrowing cost.

Deutschland Neuesten Nachrichten, Deutschland Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

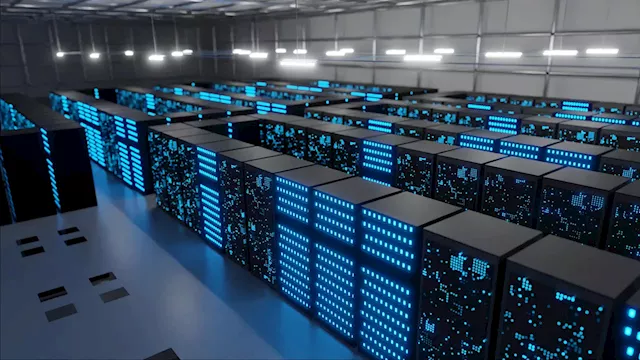

Morgan Stanley sees renewable stock rallying 50% on data center demand from tech industryThe case remains strong that load growth from data centers will be met in large part from renewables and batteries, according to Morgan Stanley.

Morgan Stanley sees renewable stock rallying 50% on data center demand from tech industryThe case remains strong that load growth from data centers will be met in large part from renewables and batteries, according to Morgan Stanley.

Herkunft: CNBC - 🏆 12. / 72 Weiterlesen »

China stocks can rally 10% in the near term, Morgan Stanley strategist saysThe CSI 300, which tracks major stocks on the Shanghai and Shenzhen exchanges, on Friday closed at 3,703.68 points, up 15.7% for the week.

China stocks can rally 10% in the near term, Morgan Stanley strategist saysThe CSI 300, which tracks major stocks on the Shanghai and Shenzhen exchanges, on Friday closed at 3,703.68 points, up 15.7% for the week.

Herkunft: CNBC - 🏆 12. / 72 Weiterlesen »