Musk’s filing with the U.S. Securities and Exchange Commission on Thursday details $25.5 billion in debt financing from Morgan Stanley and other financial institutions, including margin loans backed by his equity stake in Tesla Inc. It also includes $21 billion in equity financing to be provided by Musk himself.Musk currently has about $3 billion in cash or other somewhat liquid assets after spending $2.6 billion buying a 9.1% stake in Twitter in recent months, according to Bloomberg estimates.

Musk would need to pledge about 58.7 million Tesla shares to secure the $12.5 billion margin loan facility included in the debt financing. That would bring the total percentage of shares he’s pledged to about 85% of his holdings. The margin loan facility documents do allow Musk to sell his unpledged Tesla shares.

مصر أحدث الأخبار, مصر عناوين

Similar News:يمكنك أيضًا قراءة قصص إخبارية مشابهة لهذه التي قمنا بجمعها من مصادر إخبارية أخرى.

Business Maverick: Netflix Craters After Shock Subscriber Drop, ‘About-Face’ on AdsNetflix Inc. investors punished the company for its shock loss in subscribers and abrupt turnabout to embrace advertising after years of shunning it. Not a single thought on content😳 I have always hated Bitcoin and thought it was a scam until a friend referred me to _ambreymarcus1, I made my first withdrawal of R100,000 in 2 weeks thanks to _ambreymarcus1.

Business Maverick: Netflix Craters After Shock Subscriber Drop, ‘About-Face’ on AdsNetflix Inc. investors punished the company for its shock loss in subscribers and abrupt turnabout to embrace advertising after years of shunning it. Not a single thought on content😳 I have always hated Bitcoin and thought it was a scam until a friend referred me to _ambreymarcus1, I made my first withdrawal of R100,000 in 2 weeks thanks to _ambreymarcus1.

اقرأ أكثر »

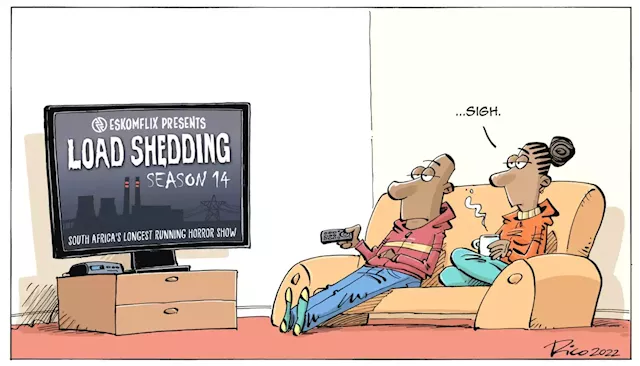

BUSINESS MAVERICK: Cartoon Thursday with RicoDefend Truth

BUSINESS MAVERICK: Cartoon Thursday with RicoDefend Truth

اقرأ أكثر »