And, like a good investor, they can provide liquidity when others desperately need it. That means buying a competitor when few if any bidders are at the table, or acquiring products, facilities and customers for pennies on the dollar.

The list from south of the border is much longer and would include Visa Inc., Danaher Corp., Coca-Cola Co., Procter & Gamble Co., tech giants such as Apple Inc., Alphabet Inc. and Microsoft Corp., and, of course, Warren Buffett’s company, Berkshire Hathaway Inc. Also, success is highly dependent on the length and depth of the economic malaise. Since the financial crisis in 2008, setbacks have been brief, with the United States Federal Reserve and other central banks coming to the rescue with lower interest rates. The economic declines were modest, and investors knew the Fed had their back.Article content

España Últimas Noticias, España Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclicalBuying stronger companies in times of weakness can give investors the nerve to be countercyclical, writes Tom Bradley. Read more.

Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclicalBuying stronger companies in times of weakness can give investors the nerve to be countercyclical, writes Tom Bradley. Read more.

Leer más »

Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclicalBuying stronger companies in times of weakness can give investors the nerve to be countercyclical, writes Tom Bradley. Read more.

Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclicalBuying stronger companies in times of weakness can give investors the nerve to be countercyclical, writes Tom Bradley. Read more.

Leer más »

Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclicalBuying stronger companies in times of weakness can give investors the nerve to be countercyclical, writes Tom Bradley. Read more.

Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclicalBuying stronger companies in times of weakness can give investors the nerve to be countercyclical, writes Tom Bradley. Read more.

Leer más »

Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclicalBuying stronger companies in times of weakness can give investors the nerve to be countercyclical, writes Tom Bradley. Read more.

Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclicalBuying stronger companies in times of weakness can give investors the nerve to be countercyclical, writes Tom Bradley. Read more.

Leer más »

Why it’s a good time to buy high-quality companiesWhen there’s a broad market selloff and everything is being hit, these names are most likely to experience the fullest and fastest recovery Lol

Why it’s a good time to buy high-quality companiesWhen there’s a broad market selloff and everything is being hit, these names are most likely to experience the fullest and fastest recovery Lol

Leer más »

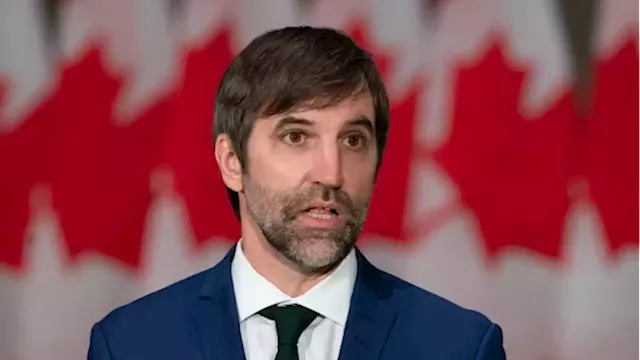

Oil and gas industry could get more time to meet 2030 emissions targets, minister says | CBC NewsCanada's environment minister says the federal government could give oil and gas companies more time to fully meet 2030 emissions reduction targets. elisevonscheel Don’t give them more time. Also, cut off Oil and Gas Subsidies immediately!!! Our Earth elisevonscheel Quite literally

Oil and gas industry could get more time to meet 2030 emissions targets, minister says | CBC NewsCanada's environment minister says the federal government could give oil and gas companies more time to fully meet 2030 emissions reduction targets. elisevonscheel Don’t give them more time. Also, cut off Oil and Gas Subsidies immediately!!! Our Earth elisevonscheel Quite literally

Leer más »