“Bullishness is relatively high while the Fed remains shy of its inflation target,” said Oppenheimer & Co.’s chief investment strategist John Stoltzfus wrote in a note to clients. He said investors should curb their enthusiasm for a long rate pause or even a rate cut and instead “right-size expectations.”

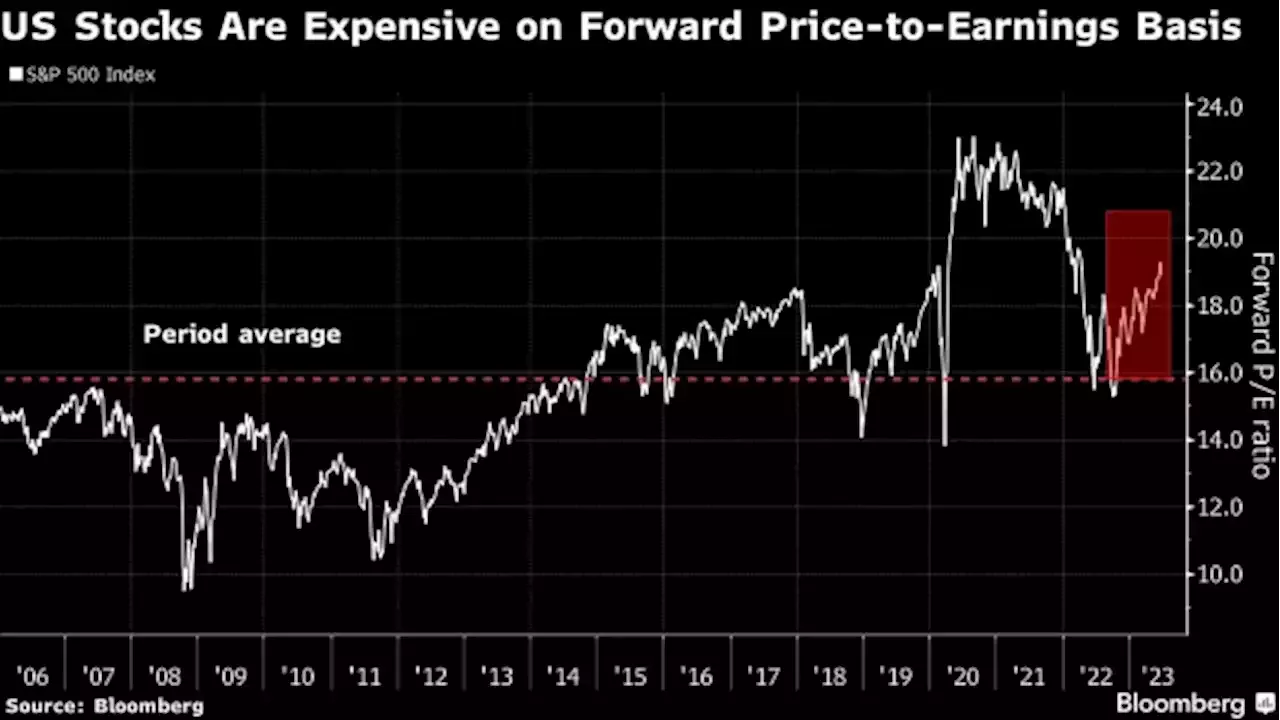

Lingering concerns that a strong economy will prompt the US Federal Reserve to hold interest rates higher for longer has been weighing on stocks, with the US benchmark sliding 3% since a peak in late July. A buzz around artificial intelligence has been boosting the S&P 500 Index for most of this year, ignoring risks from rates and a potential economic slowdown.

Stoltzfus’ peers at Deutsche Bank AG also see a “modest extension of the current pullback.” Citing historical data, strategists including Parag Thatte and Bankim Chadha said modest equity pullbacks of 3%-5% typically occur every two to three months. Meanwhile, Goldman Sachs Gropup Inc. strategist David Kostin is more positive on the prospects of a soft landing of the US economy and sees the S&P 500 index climbing to 4,700 in the next 12 months. Morgan Stanley’s Michael Wilson disagrees, saying US stock investors are in for disappointment as economic growth is set to be weaker than expected this year.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

The Big Bet on Luxury Stocks Stumbles on Inflation, China WoesProblems are stacking up for Europe’s hottest sector.

The Big Bet on Luxury Stocks Stumbles on Inflation, China WoesProblems are stacking up for Europe’s hottest sector.

Lire la suite »

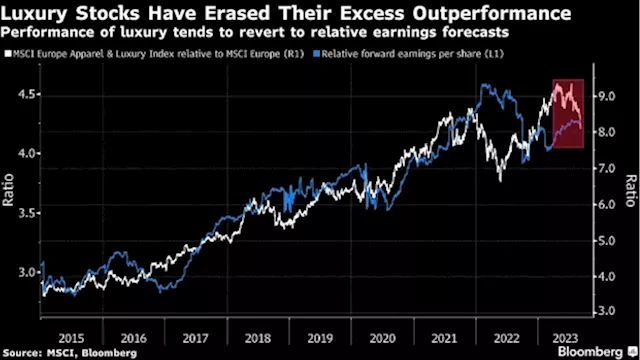

The Big Bet on Luxury Stocks Stumbles on Inflation, China Woes(Bloomberg) -- Problems are stacking up for Europe’s hottest sector.Most Read from BloombergBoss of Failed Crypto Exchange Gets 11,000-Year SentenceCalifornia Shows an Electric-Car Uprising Headed for the USEverything Apple Plans to Show on Sept. 12: iPhone 15, Watches, AirPodsUS, EU Agree on Mideast-India Rail and Shipping Corridor at G-20Ex-Google CEO Eric Schmidt Scraps $67.6 Million Purchase of Abandoned SuperyachtA warning from the chairman of Cartier-owner Richemont that stubborn inflation

The Big Bet on Luxury Stocks Stumbles on Inflation, China Woes(Bloomberg) -- Problems are stacking up for Europe’s hottest sector.Most Read from BloombergBoss of Failed Crypto Exchange Gets 11,000-Year SentenceCalifornia Shows an Electric-Car Uprising Headed for the USEverything Apple Plans to Show on Sept. 12: iPhone 15, Watches, AirPodsUS, EU Agree on Mideast-India Rail and Shipping Corridor at G-20Ex-Google CEO Eric Schmidt Scraps $67.6 Million Purchase of Abandoned SuperyachtA warning from the chairman of Cartier-owner Richemont that stubborn inflation

Lire la suite »

China Eases Rules for Insurers Buying Stocks in Support MeasureChina will make it easier for insurance companies to invest in domestic stocks, the latest in a series of measures aimed at shoring up market sentiment.

China Eases Rules for Insurers Buying Stocks in Support MeasureChina will make it easier for insurance companies to invest in domestic stocks, the latest in a series of measures aimed at shoring up market sentiment.

Lire la suite »

Stocks Set for Cautious Open; Yen Advances on Ueda: Markets WrapAsian equities may struggle to find traction Monday in a cautious open to trading around the region, while in currency markets the yen was on the front foot following potentially hawkish remarks for the Bank of Japan governor.

Stocks Set for Cautious Open; Yen Advances on Ueda: Markets WrapAsian equities may struggle to find traction Monday in a cautious open to trading around the region, while in currency markets the yen was on the front foot following potentially hawkish remarks for the Bank of Japan governor.

Lire la suite »

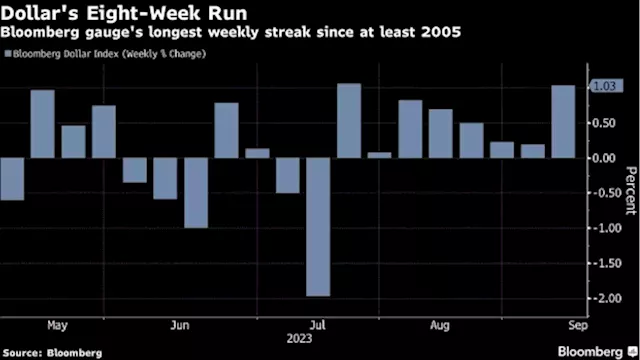

Stocks Set for Cautious Open; Yen Advances on Ueda: Markets Wrap(Bloomberg) -- Asian equities may struggle to find traction Monday in a cautious open to trading around the region, while in currency markets the yen was on the front foot following potentially hawkish remarks for the Bank of Japan governor.Most Read from BloombergTrudeau Is Stuck in India With Faulty Aircraft After Hearing Criticism From ModiIndia’s G-20 Win Shows US Learning How to Counter China RiseMeloni Tells China That Italy Plans to Exit Belt and RoadBoss of Failed Crypto Exchange Gets 11

Stocks Set for Cautious Open; Yen Advances on Ueda: Markets Wrap(Bloomberg) -- Asian equities may struggle to find traction Monday in a cautious open to trading around the region, while in currency markets the yen was on the front foot following potentially hawkish remarks for the Bank of Japan governor.Most Read from BloombergTrudeau Is Stuck in India With Faulty Aircraft After Hearing Criticism From ModiIndia’s G-20 Win Shows US Learning How to Counter China RiseMeloni Tells China That Italy Plans to Exit Belt and RoadBoss of Failed Crypto Exchange Gets 11

Lire la suite »

Marketmind: China's weak property stocks set the paceA look at the day ahead in European and global markets from Kevin Buckland A light calendar for Europe today means markets are likely to take their cues ...

Marketmind: China's weak property stocks set the paceA look at the day ahead in European and global markets from Kevin Buckland A light calendar for Europe today means markets are likely to take their cues ...

Lire la suite »