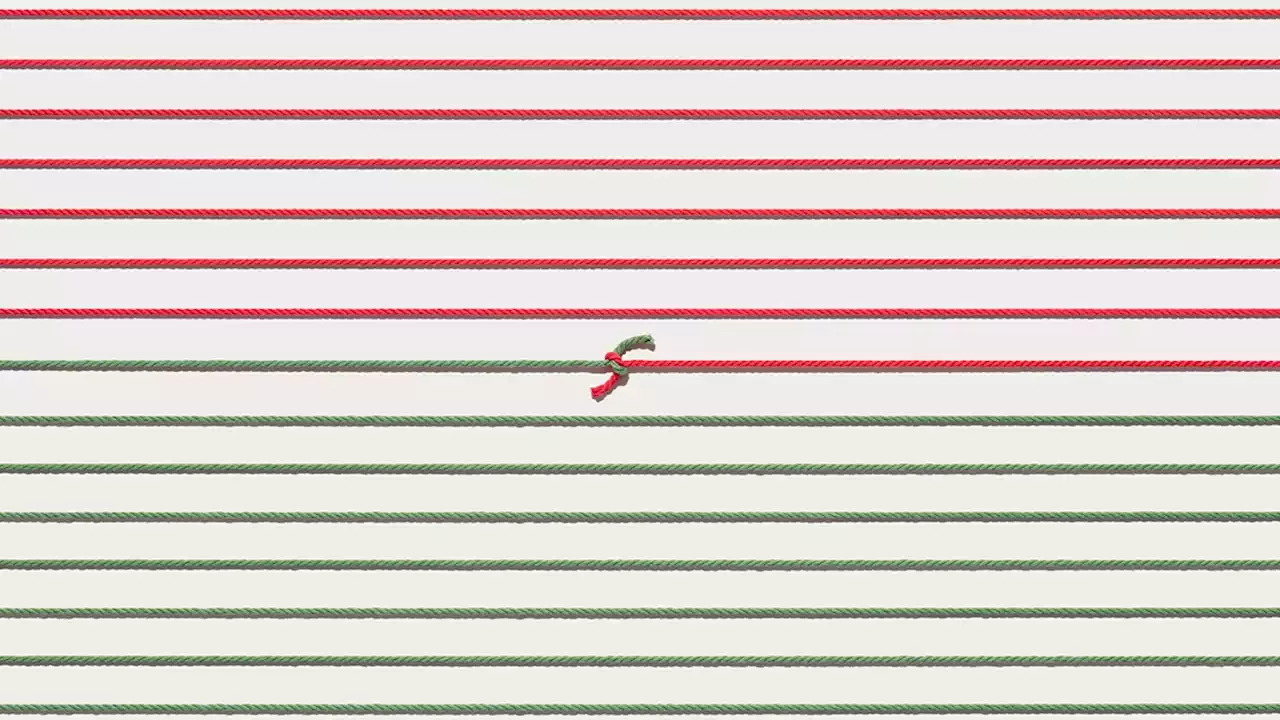

Even in flush times, this cycle eventually risks the company’s failure altogether, as time and money get spent without sustainably generating any new innovations.

Now, as the era of low interest rates and cheap money ends, many companies urgently need a new approach to strategic governance. To escape the trap, companies must replace the top-down approach of M&A with a more inclusive and bottom-up approach to innovation. While M&Alike a cheap way to become more innovative, the most important information for innovation comes from inside the firm — from those close to customers, clients, suppliers, and technologies.

That’s my company. That’s why it hasn’t been going anywhere the past 2.5 years

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Ryan continues M&A streak by acquiring tax product lines from Thomson Reuters - Dallas Business JournalThe acquisitions make Ryan the largest property tax software provider in North America.

Ryan continues M&A streak by acquiring tax product lines from Thomson Reuters - Dallas Business JournalThe acquisitions make Ryan the largest property tax software provider in North America.

Baca lebih lajut »