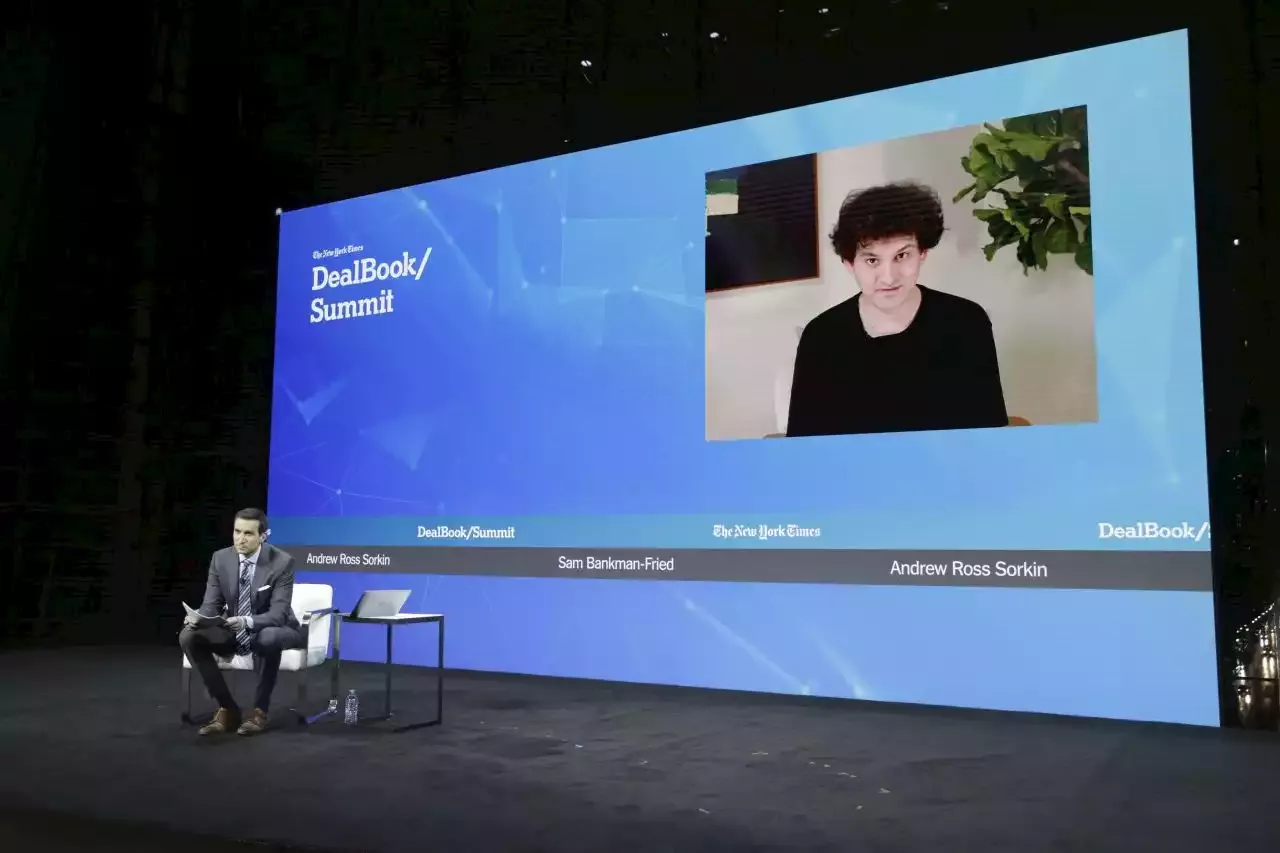

The fallen crypto mogul held all his assets in his now-bankrupt FTX exchange and sister trading house Alameda Research, he said in a video interview with columnist Andrew Ross Sorkin at the New York Times DealBook Summit on Wednesday.

“I don’t know the details of the house for my parents — I know it was not intended to be their long-term property, it was intended to be the company’s property,” he said. Other purchases were made so employees who relocated to the Bahamas “had an easy way to find a comfortable life that they’d be willing to move and help build out the product.”

Then it all came crashing down. As he told it, his swift demise began in early November when crypto news site CoinDesk reported on Alameda’s balance sheet, showing that a token issued by FTX, FTT, made up about a quarter of the trading house’s $14.6 billion in assets.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Business Maverick: Bankman-Fried denies trying to commit fraud at fallen FTX empireMystery continues to shroud the missing billions at bankrupt crypto exchange FTX after its disgraced founder Sam Bankman-Fried denied trying to perpetrate a fraud while admitting to grievous managerial errors.

Business Maverick: Bankman-Fried denies trying to commit fraud at fallen FTX empireMystery continues to shroud the missing billions at bankrupt crypto exchange FTX after its disgraced founder Sam Bankman-Fried denied trying to perpetrate a fraud while admitting to grievous managerial errors.

Baca lebih lajut »