A planned tie-up between paper and packaging giant Smurfit Kappa Group Plc and WestRock Co. of the US would result in the cancellation of the Dublin-based company’s premium listing on the London Stock Exchange. Smurfit Kappa has been a member of the exchange’s benchmark FTSE 100 Index since 2016.

It’s missed out on the hottest initial public offering of the year, with chip designer Arm Holdings Ltd. shunning its home market for a New York listing. Meanwhile, building materials company CRH Plc is due to move its main listing from London to New York this month and gambling firm Flutter Entertainment Plc is planning a secondary US listing in early 2024.

The low valuation of the UK stock market has hastened the exodus by encouraging foreign companies and private equity firms to buy and delist British companies. It’s also pushing UK businesses to consider listing elsewhere in hopes of securing a richer value for their shares. And the UK’s slumping economy has pushed investor dollars into other markets.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

WestRock, Smurfit in Merger Talks for $20 Billion Paper FirmPaper and packaging giants WestRock Co. and Smurfit Kappa Group Plc are in talks to merge, potentially creating an industry giant with a market value of about $20 billion.

WestRock, Smurfit in Merger Talks for $20 Billion Paper FirmPaper and packaging giants WestRock Co. and Smurfit Kappa Group Plc are in talks to merge, potentially creating an industry giant with a market value of about $20 billion.

Baca lebih lajut »

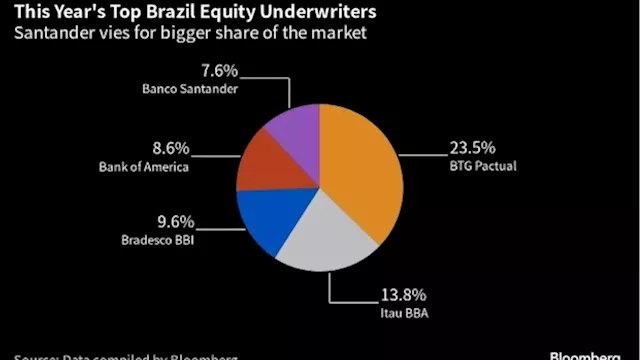

Ex-Credit Suisse Investment Bankers Join Santander in BrazilBanco Santander SA hired two more Credit Suisse investment bankers in Brazil in its push to expand in equity underwriting and merger-and-acquisition advice.

Ex-Credit Suisse Investment Bankers Join Santander in BrazilBanco Santander SA hired two more Credit Suisse investment bankers in Brazil in its push to expand in equity underwriting and merger-and-acquisition advice.

Baca lebih lajut »