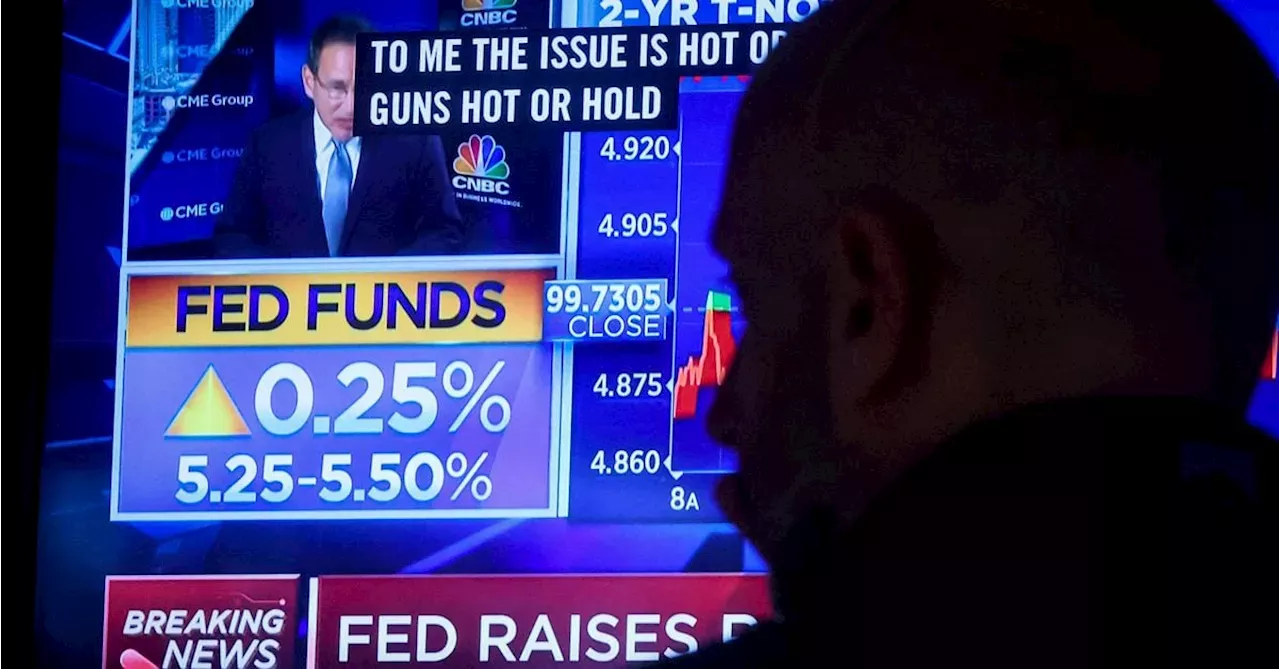

A trader reacts as a screen displays the Fed rate announcement on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., July 26, 2023. REUTERS/Brendan McDermid/File Photoreport is bolstering hopes that the Federal Reserve can bring down consumer prices without hurting the economy, a so-called Goldilocks environment that investors believe will benefit stocks and bonds.

Both asset classes have ripped higher in November following a months-long wobble, fueled by hopes that the Fed was unlikely to deliver any more of theInflation data released on Tuesday supported the view that a turning point is near: consumer prices were unchanged on a monthly basis for October, the first such reading in more than a year and a softer figure than analysts were expecting.“The broader market has been challenged with this consensus negative view about both a recession and inflation," said Eric Kuby, chief investment officer at North Star Investment Management Corp. "Reality is telling a different story. This does feel like a Goldilocks moment for the entire marke

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Wind power industry in moment of reckoning as stocks fall and earnings crumbleRenewable energy firms are mostly suffering a dire earnings season as struggling supply chains, manufacturing faults and rising production costs eat into profits.

Wind power industry in moment of reckoning as stocks fall and earnings crumbleRenewable energy firms are mostly suffering a dire earnings season as struggling supply chains, manufacturing faults and rising production costs eat into profits.

Baca lebih lajut »

Stocks Are Poised to FallThis week includes a race on Capitol Hill to pass a temporary government funding bill and the release of the latest consumer price index data.

Stocks Are Poised to FallThis week includes a race on Capitol Hill to pass a temporary government funding bill and the release of the latest consumer price index data.

Baca lebih lajut »