When WeWork this spring stopped paying rent at an office tower in the heart of San Francisco, it dealt an especially harsh blow to the building’s landlord.

A year earlier, when WeWork was still a darling of the venture-capital world, its co-founder and former CEO Adam Neumann pitched ARK to its main backer, SoftBank, as one of three arms of the company that would be “a $1 trillion business of its own,” according to the Wall Street Journal. Unraveling more leases might provide it more wiggle room, but the company also risks inflicting painful losses to ARK, particularly in San Francisco, a place where commercial property values have tumbled and many lenders and landlords no longer want to operate.Exposure on all sides While San Francisco doesn’t have a huge exposure to WeWork relative to New York City or Los Angeles, its footprint in the city is substantial, and its lease at 600 California is for half its rentable space.

WeWork has been fairly successful in “wiggling out of its leases,” said Brian Quintrell at KBRA Credit Profile, even though his team notes that WeWork could end up on both sides of the negotiating table at 600 California when it comes to any debt relief. Bond documents for the building’s 2019 financing show the borrower group had $130 million of equity in the property at a $370 million valuation.

WeWork was rapidly expanding it footprint in many big cities at a time when leases were fetching peak rents. While many people think co-working space has a place in the real-estate landscape as more companies embrace flexible work, WeWork’s rapid growth mostly came when interest rates were low and property values were high.

Ireland Ireland Latest News, Ireland Ireland Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

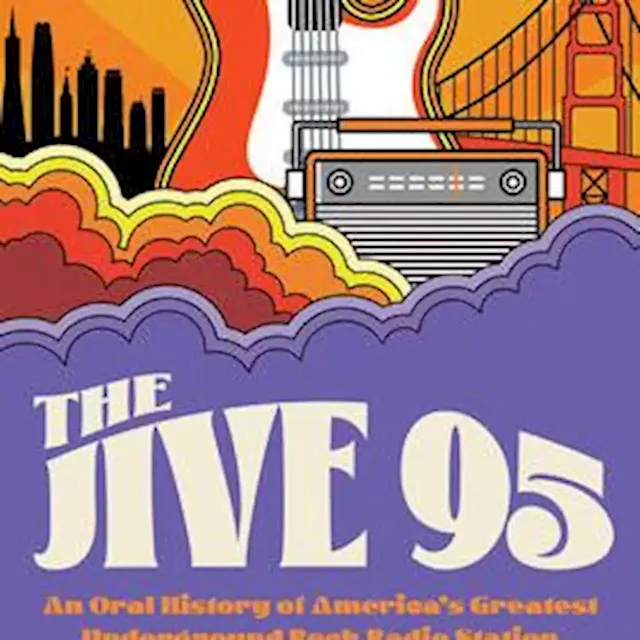

Book about San Francisco radio station KSAN hits the marketJive 95 chronicles legendary underground San Francisco rock station and the people who made it tick

Book about San Francisco radio station KSAN hits the marketJive 95 chronicles legendary underground San Francisco rock station and the people who made it tick

Source: sfexaminer - 🏆 236. / 63 Read more »