Investors once again penciling in a pivot to rate cuts by the Federal Reserve aren’t getting any backup from a closely watched gauge of expected stock-market volatility, one Wall Street analyst warned Wednesday.

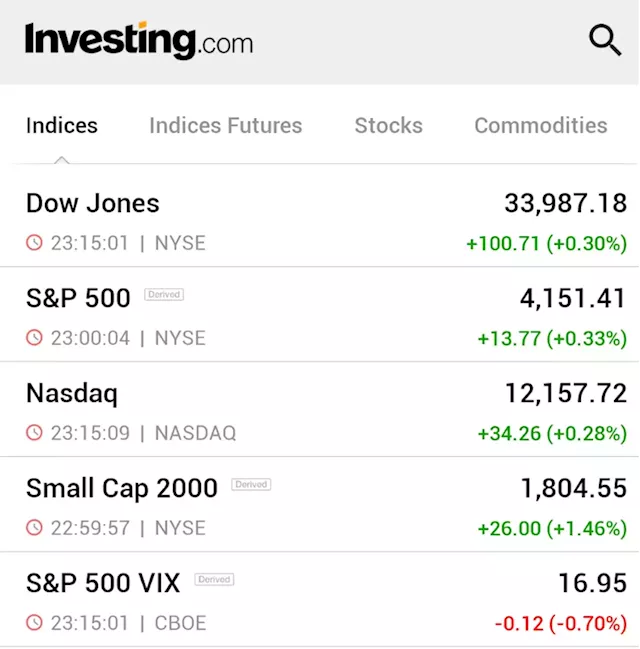

The Cboe Volatility Index VIX , commonly referred to by its ticker symbol, “VIX,” closed Tuesday at 16.83, its lowest finish since Jan. 3, 2022, according to Dow Jones Market Data. The options-based index measures expectations for S&P 500 SPX volatility over the next 30 days. It remains well below its long-term average of around 20.

So far the VIX isn’t offering any signs the Fed put is likely to be exercised. The Fed has often, but not always, cut rates when the VIX has spiked, Colas recalled, including right after the 1990 Iraqi invasion of Kuwait, during the 1998 Asia Crisis, heading into the 2002 and 2008 recessions, and at the start of the pandemic in 2020.

Italia Ultime Notizie, Italia Notizie

Similar News:Puoi anche leggere notizie simili a questa che abbiamo raccolto da altre fonti di notizie.

Wall St ends higher; investors await earnings, Fed cues By Reuters⚠️BREAKING: *DOW JUMPS 100 POINTS AS U.S. STOCKS END HIGHER TO START BUSY EARNINGS WEEK *VIX FALLS TO LOWEST LEVEL SINCE JANUARY 2022 $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸 It doesn’t matter Also watching these $NFLX levels for their report tomorrow👇🏽 For all the traders + investors Here’s the $TSLA levels to watch into Wednesday👇🏽

Wall St ends higher; investors await earnings, Fed cues By Reuters⚠️BREAKING: *DOW JUMPS 100 POINTS AS U.S. STOCKS END HIGHER TO START BUSY EARNINGS WEEK *VIX FALLS TO LOWEST LEVEL SINCE JANUARY 2022 $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸 It doesn’t matter Also watching these $NFLX levels for their report tomorrow👇🏽 For all the traders + investors Here’s the $TSLA levels to watch into Wednesday👇🏽

Leggi di più »

Wall St ends higher; investors await earnings, Fed cuesMajor U.S. stock indexes posted modest gains on Monday, helped by financial and industrial shares, while investors braced for a heavy week of corporate results and comments from Federal Reserve officials that could give more insight into the path of interest rates. China, and Richard, the Emperor What kind of assets we’re driving this? Gold , Silver , Platinum, Copper , Lithium or Petroleum So called “Hard assets “ ?

Wall St ends higher; investors await earnings, Fed cuesMajor U.S. stock indexes posted modest gains on Monday, helped by financial and industrial shares, while investors braced for a heavy week of corporate results and comments from Federal Reserve officials that could give more insight into the path of interest rates. China, and Richard, the Emperor What kind of assets we’re driving this? Gold , Silver , Platinum, Copper , Lithium or Petroleum So called “Hard assets “ ?

Leggi di più »

Here's how different stock-market styles have performed during Fed rate pausesTraders and analysts are expecting one last Federal Reserve interest-rate hike in May before policymakers hit the pause button.

Here's how different stock-market styles have performed during Fed rate pausesTraders and analysts are expecting one last Federal Reserve interest-rate hike in May before policymakers hit the pause button.

Leggi di più »