shares hit an intraday low of $31.78 - their lowest in more than a decade. The stock has lost nearly 35% since the release of the report.and relying on a "Ponzi-like" structure to pay dividends. Icahn called the report "self-serving."of his stake as collateral for personal loans.

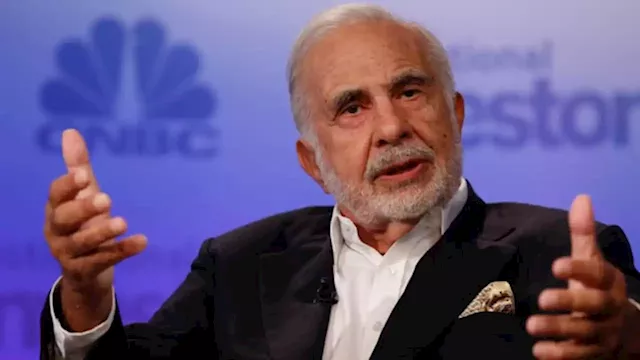

Since its release on Tuesday, the Hindenburg report has wiped $7.5 billion off Icahn's fortune, leaving him with a net worth of $10.8 billion, according to Forbes. "Activist short attacks a few days before an issuer reports earnings are common because regulatory quiet periods can limit the issuer's ability to respond and catch them off-guard," said Josh Black, editor-in-chief ofIcahn Enterprises is scheduled to report its first-quarter earnings on Friday.

The attack has landed the famed corporate raider in uncharted waters. Known for his face-offs with industry heavyweights like McDonald's CorpBut Hindenburg has taken on several high-profile targets in recent months, including India's conglomerate Adani Group and Jack Dorsey-led digital payments platform Block IncReporting by Niket Nishant in Bengaluru; Editing by Saumyadeb Chakrabarty

Italia Ultime Notizie, Italia Notizie

Similar News:Puoi anche leggere notizie simili a questa che abbiamo raccolto da altre fonti di notizie.

Icahn Enterprises stock skids lower as short seller Hindenburg puts Carl Icahn's company in crosshairsHindenburg Research said it is betting against Icahn Enterprises and contends the company is overvalued compared with peers.

Icahn Enterprises stock skids lower as short seller Hindenburg puts Carl Icahn's company in crosshairsHindenburg Research said it is betting against Icahn Enterprises and contends the company is overvalued compared with peers.

Leggi di più »

Hindenburg Research goes after Carl Icahn in latest campaign for market-moving short sellerThe Nathan Anderson-led firm took a short position against Icahn Enterprises, alleging 'inflated' asset valuations, among other reasons.

Hindenburg Research goes after Carl Icahn in latest campaign for market-moving short sellerThe Nathan Anderson-led firm took a short position against Icahn Enterprises, alleging 'inflated' asset valuations, among other reasons.

Leggi di più »