Data compiled by S3 Partners showed total short interest in the U.S. topped $1 trillion in the first six months of 2023, up from $864 billion at the end of last year.

"While short sellers were actively shorting into a rising market, that does not necessarily mean that they were solely betting on a reversal in an overheated or overbought market," he added. "A significant portion of the short selling was due to an increase in hedge fund leverage as they increased both their long and short exposure.

He said that "extended markets and overbought conditions set the stage for a natural and healthy period of consolidation as we approach earnings season." "With risks to the economy still high, we favor fixed income over equities," said Solita Marcelli, chief investment officer at UBS Global Wealth Management. "We continue to favor high- quality fixed income, including government and investment grade bonds, which stand to gain in the event of a swifter-than-expected economic slowdown."

Italia Ultime Notizie, Italia Notizie

Similar News:Puoi anche leggere notizie simili a questa che abbiamo raccolto da altre fonti di notizie.

Here's what stock-market investors --- and probably the Fed --- don't like about the June jobs reportWhy stock-market investors find wage data in the June jobs report unsettling

Here's what stock-market investors --- and probably the Fed --- don't like about the June jobs reportWhy stock-market investors find wage data in the June jobs report unsettling

Leggi di più »

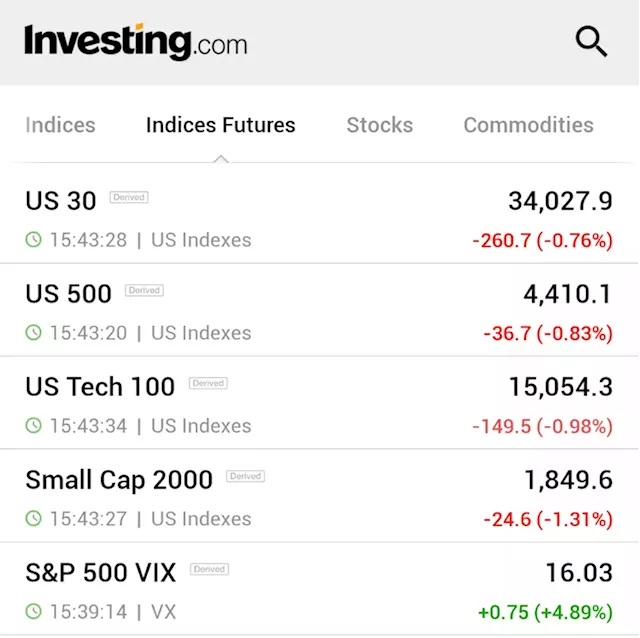

Stock market today: Dow slips as Fed minutes show more hikes ahead; Meta jumps By Investing.com*U.S. STOCKS END LOWER ON WEDNESDAY AS FED MINUTES SHOW MORE RATE HIKES AHEAD $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Stock market today: Dow slips as Fed minutes show more hikes ahead; Meta jumps By Investing.com*U.S. STOCKS END LOWER ON WEDNESDAY AS FED MINUTES SHOW MORE RATE HIKES AHEAD $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Leggi di più »

Dow futures retreat; labor market data in focus By Investing.com⚠️BREAKING: *U.S. STOCK FUTURES EXTEND SELLOFF AS STRONG JOBS DATA POINTS TO MORE FED TIGHTENING $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Dow futures retreat; labor market data in focus By Investing.com⚠️BREAKING: *U.S. STOCK FUTURES EXTEND SELLOFF AS STRONG JOBS DATA POINTS TO MORE FED TIGHTENING $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Leggi di più »